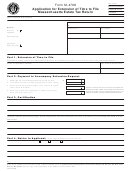

Form M-4768A Instructions

Who May File

must be paid before the expiration of such period, plus the

interest thereon from the original due date of the return, to

This application may be filed by an executor or administra-

the date of payment.

tor, or if there is no executor or administrator appointed,

qualified and acting within the Commonwealth, then by any

Note: An extension of time to pay does not extend the due

person in actual or constructive possession of any property

date for filing of the return. Form M-4768, Application for

of the decedent.

Extension of Time to File Massachusetts Estate Tax Return,

may be filed, if necessary.

Due Date of Massachusetts Estate Tax

Return, Form M-706

When to File

Form M-706, Estate Tax Return, is due within nine months

File this application sufficiently early to permit the Mass-

after the date of decedent’s death (with respect to those

achusetts Estate Tax Bureau to consider the application

estates of decedents dying on or after January 1, 1976). The

and reply before the due date of the return. An extension of

tax is due at the time of filing the return.

time to pay shall only be granted if application is made prior

to the due date of the return.

Specific Instructions

How and Where to File

An extension of time to pay must be for a reasonable period,

not to exceed six months. If, however, the Commissioner

Complete this form in duplicate and file with the Massachu-

finds that payment on the due date would result in undue

setts Department of Revenue, Estate Tax Bureau, PO Box

hardship, he may extend the payment date for a period not

7023, Boston, MA 02204.

in excess of three years from the due date of the tax.

Interest

An application based on reasonable cause must establish

Any unpaid portion of the tax finally determined to be due

why it is impossible or impracticable for the executor to pay

will bear interest from the original due date of the return to

the full amount of the estate tax on or before the due date.

the date of payment.

An application based on undue hardship must establish

such undue hardship that would result to the estate if the

Penalties

application is denied.

If the Massachusetts Estate Tax is not timely paid, a penalty

¹⁄₂% per month, or fraction

This application will be granted only for the amount of the

shall be imposed at the rate of

cash shortage. The amount of the estate tax, the cash

thereof, to a maximum of 25% of the unpaid balance.

shortage and the balance due should be indicated. Make a

If the Massachusetts Estate Tax Return is not timely filed,

check payable to the Commonwealth of Massachusetts for

a penalty shall be imposed at the rate of 1% per month,

the balance due. Enter the decedent’s Social Security num-

or fraction thereof, to a maximum of 25% of the unpaid

ber on the check.

balance.

The Massachusetts Estate Tax Bureau will complete the

form and return a copy to the applicant. If the application is

Bond

approved, attach a copy to the estate tax return filed. The

If an extension of time to pay is granted, the executor may

part of the estate tax for which the extension is granted

be required to furnish a bond.

1

1 2

2