Form Mo-1040 - Individual Income Tax Return - Long Form - 2014 Page 26

ADVERTISEMENT

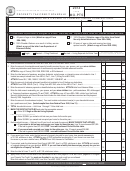

QUALIFIED HEALTH INSURANCE PREMIUMS WORKSHEET FOR MO-A, LINE 11

Complete this worksheet and attach it, along with proof of premiums paid, to Form MO-1040 if you included health

insurance premiums paid as an itemized deduction or had health insurance premiums withheld from your social security

benefits.

If you had premiums withheld from your social security benefits, complete Lines 1 through 4 to determine your taxable

percentage of social security income and the corresponding taxable portion of your health insurance premiums included

in your taxable income.

1. Enter the amount from Federal Form 1040A, Line 14a, or Federal Form 1040, Line

20a. If $0, skip to Line 6 and enter your total health insurance premiums paid.

1. _____________

. . . . . .

2. Enter amount from Federal Form 1040A, Line 14b or Federal Form 1040,

Line 20b.

2. _____________

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Divide Line 2 by Line 1.

3. _____________%

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yourself

Spouse

4. Enter the health insurance premiums withheld from your social

security income.

4Y. _____________

4S. _____________

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Multiply the amounts on Line 4Y and 4S by the percentage on Line 3.

5Y. _____________

5S. _____________

. . . . .

6. Enter the total of all other health insurance premiums paid, which

were not included on 4Y or 4S.

6Y. _____________

6S. _____________

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. Add the amounts from Lines 5 and 6.

7Y. _____________

7S. _____________

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Add the amounts from Lines 7Y and 7S.

8Y. _____________

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. Divide Line 7Y and 7S by the total found on Line 8. If you itemized on your

federal return and your federal itemized deductions included health insurance

premiums as medical expenses, go to Line 10. If not, go to Line 15.

9Y. ____________% 9S. ____________%

. . . . . . . . .

10 . Enter the amount from Federal Schedule A, Line 1.

10. _____________

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11. Enter the amount from Federal Schedule A, Line 4.

11. _____________

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12. Divide Line 11 by Line 10 (round to full percent).

12. _____________%

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. Multiply Line 8 by percent on Line 12.

13. _____________

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14. Subtract Line 13 from Line 8.

14. _____________

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15. Enter your federal taxable income from Federal Form 1040A, Line 27, or

Federal Form 1040, Line 43.

15. _____________

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16. If you itemized on your federal return and completed Lines 10 through 14 above,

enter the amount from Line 14 or Line 15, whichever is less.

If not, enter the amount from Line 8 or Line 15, whichever is less.

16. _____________

. . . . . . . . . . . . . . . . . . .

17. Multiply Line 16 by the percentage on Line 9Y and Line 9S.

Enter the amounts on Line 17Y and 17S of this worksheet on Line 11

of Form MO-A.

17Y. _____________ 17S. ____________

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44