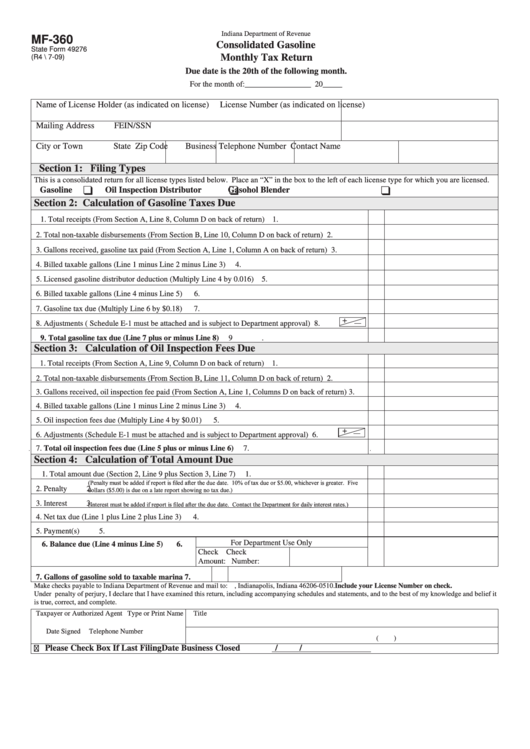

Indiana Department of Revenue

MF-360

Consolidated Gasoline

State Form 49276

Monthly Tax Return

(R4 \ 7-09)

Due date is the 20th of the following month.

For the month of:_________________ 20_____

Name of License Holder (as indicated on license)

License Number (as indicated on license)

Mailing Address

FEIN/SSN

City or Town

State

Zip Code

Business Telephone Number Contact Name

Section 1: Filing Types

This is a consolidated return for all license types listed below. Place an “X” in the box to the left of each license type for which you are licensed.

Gasoline

Oil Inspection Distributor

Gasohol Blender

Section 2: Calculation of Gasoline Taxes Due

1. Total receipts (From Section A, Line 8, Column D on back of return)

1.

2. Total non-taxable disbursements (From Section B, Line 10, Column D on back of return)

2.

3. Gallons received, gasoline tax paid (From Section A, Line 1, Column A on back of return)

3.

4. Billed taxable gallons (Line 1 minus Line 2 minus Line 3)

4.

5. Licensed gasoline distributor deduction (Multiply Line 4 by 0.016)

5.

6. Billed taxable gallons (Line 4 minus Line 5)

6.

7. Gasoline tax due (Multiply Line 6 by $0.18)

7.

+

8. Adjustments ( Schedule E-1 must be attached and is subject to Department approval)

8.

9. Total gasoline tax due (Line 7 plus or minus Line 8)

9.

Section 3: Calculation of Oil Inspection Fees Due

1. Total receipts (From Section A, Line 9, Column D on back of return)

1.

2. Total non-taxable disbursements (From Section B, Line 11, Column D on back of return)

2.

3. Gallons received, oil inspection fee paid (From Section A, Line 1, Columns D on back of return)

3.

4. Billed taxable gallons (Line 1 minus Line 2 minus Line 3)

4.

5. Oil inspection fees due (Multiply Line 4 by $0.01)

5.

+

6. Adjustments (Schedule E-1 must be attached and is subject to Department approval)

6.

7. Total oil inspection fees due (Line 5 plus or minus Line 6)

7.

Section 4: Calculation of Total Amount Due

1.

Total amount due (Section 2, Line 9 plus Section 3, Line 7)

1.

(Penalty must be added if report is filed after the due date. 10% of tax due or $5.00, whichever is greater. Five

2.

Penalty

2.

dollars ($5.00) is due on a late report showing no tax due.)

(Interest must be added if report is filed after the due date. Contact the Department for daily interest rates.)

3.

Interest

3.

4.

Net tax due (Line 1 plus Line 2 plus Line 3)

4.

5.

Payment(s)

5.

For Department Use Only

6.

Balance due (Line 4 minus Line 5)

6.

Check

Check

Amount:

Number:

7.

Gallons of gasoline sold to taxable marina

7.

Make checks payable to Indiana Department of Revenue and mail to: P.O. Box 510, Indianapolis, Indiana 46206-0510. Include your License Number on check.

Under penalty of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief it

is true, correct, and complete.

Taxpayer or Authorized Agent

Type or Print Name

Title

Date Signed

Telephone Number

(

)

❑

Please Check Box If Last Filing

Date Business Closed

/

/

1

1 2

2 3

3 4

4