Section 3

For Additional Information

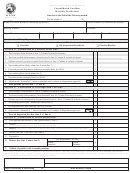

Calculation Of Oil Inspection Fees Due

Contact our office any weekday at (317) 615-2630 to obtain ad-

Line 1: Enter the total amount of gasoline, kerosene and other

products purchased, acquired or imported during the month (from

ditional information. You may send us an email at

fetax@dor.

Section A, Line 9, Column D on back of return).

in.gov, or you may also write to:

Line 2: Enter the total of non-taxable disbursements made during

Indiana Department of Revenue

the month (from Section B, Line 11, Column D on back of return).

Fuel Tax Section

P.O. Box 510

Line 3: Enter the total gallons received, oil inspection fee paid

Indianapolis, IN 46206-0510

(from Section A, Line 1, Column D).

Line 4: Enter the total billed taxable gallons (Line 1 minus Line

2 minus Line 3).

Line 5: Enter the tax due (multiply Line 4 by $.01).

Line 6: Enter any adjustments not accommodated elsewhere on

this return. For adjustments taken on this line, Schedule E-1 must

be attached. Failure to complete and attach Schedule E-1 will

result in your adjustment being disallowed. If Line 6 is a negative

amount, be certain that you circle the “-” sign in the box to the left

of your Line 6 entry.

Line 7: Enter the total oil inspection fee due (Line 5 plus or minus

Line 6).

Section 4

Calculation of Total Amount Due

Line 1: Enter your total combined tax due (Section 2, Line 9 plus

Section 3, Line 7).

Line 2: Enter 10% penalty on any tax that is submitted after the

due date.

Line 3: Enter the interest due on any late payment(s) of tax. To

find the interest rate for the current year, see the interest rate section

of the Fuel Tax Handbook.

Line 4: Enter the total tax due (Line 1 plus Line 2 plus Line 3).

Line 5: Enter any EFT payment(s) made.

Line 6: Enter the balance due. Enclose a check or money order

made payable to the Indiana Department of Revenue for the bal-

ance due.

Line 7: Indicate the total number of gallons of gasoline (including

gasohol) sold to persons who own or operate taxable marine facilities

upon which the gasoline tax was collected. The “taxable marine

facility” means a boat livery located on an Indiana lake.

1

1 2

2 3

3 4

4