Form Ft-935 - Certification Of Taxes Paid On Motor Fuel

ADVERTISEMENT

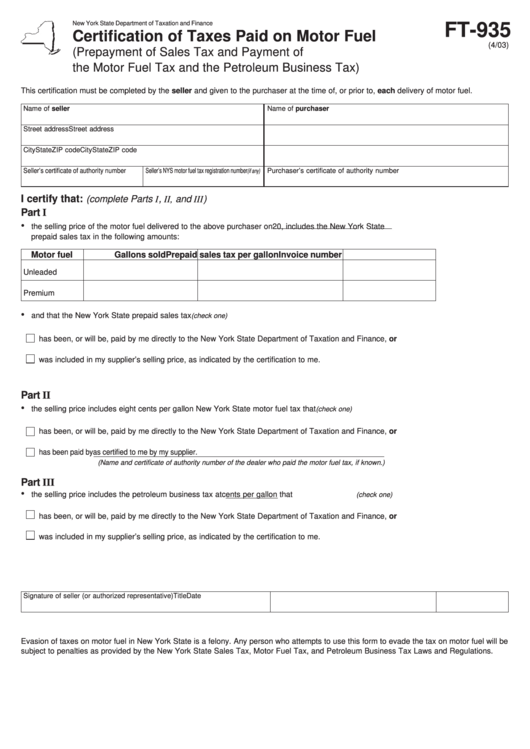

New York State Department of Taxation and Finance

FT-935

Certification of Taxes Paid on Motor Fuel

(4/03)

(Prepayment of Sales Tax and Payment of

the Motor Fuel Tax and the Petroleum Business Tax)

This certification must be completed by the seller and given to the purchaser at the time of, or prior to, each delivery of motor fuel.

Name of seller

Name of purchaser

Street address

Street address

City

State

ZIP code

City

State

ZIP code

Seller’s certificate of authority number

Seller’s NYS motor fuel tax registration number

Purchaser’s certificate of authority number

(if any)

I certify that:

(complete Parts I , II, and III )

Part I

•

the selling price of the motor fuel delivered to the above purchaser on

20

, includes the New York State

prepaid sales tax in the following amounts:

Motor fuel

Gallons sold

Prepaid sales tax per gallon

Invoice number

Unleaded

Premium

•

and that the New York State prepaid sales tax

(check one)

has been, or will be, paid by me directly to the New York State Department of Taxation and Finance, or

was included in my supplier’s selling price, as indicated by the certification to me.

Part II

•

the selling price includes eight cents per gallon New York State motor fuel tax that

(check one)

has been, or will be, paid by me directly to the New York State Department of Taxation and Finance, or

has been paid by

as certified to me by my supplier.

(Name and certificate of authority number of the dealer who paid the motor fuel tax, if known.)

Part III

•

the selling price includes the petroleum business tax at

cents per gallon that

(check one)

has been, or will be, paid by me directly to the New York State Department of Taxation and Finance, or

was included in my supplier’s selling price, as indicated by the certification to me.

Signature of seller (or authorized representative)

Title

Date

Evasion of taxes on motor fuel in New York State is a felony. Any person who attempts to use this form to evade the tax on motor fuel will be

subject to penalties as provided by the New York State Sales Tax, Motor Fuel Tax, and Petroleum Business Tax Laws and Regulations.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2