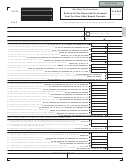

Form Ft-935 - Certification Of Taxes Paid On Motor Fuel Page 2

ADVERTISEMENT

FT-935 (4/03) (back)

General information

Each sale of motor fuel in New York State for purposes of resale

If providing a certification at the time of delivery is impossible due

must have a certification of tax payments from the seller to the

to the circumstances of delivery (for example, sales at an

purchaser. However, a certification of tax payment is not necessary

unmanned terminal), a seller may request permission from the

for transfers made before or during the importation of the motor fuel

Tax Department to use preliminary certifications. A seller should

into New York State.

send a request to issue preliminary certifications to: NYS Tax

Department, TTTB-FACCTS, W A Harriman Campus, Albany NY

To the seller:

12227.

This certificate may be reproduced or may be incorporated into any

To the purchaser:

invoice or other billing document if all the information (including the

seller’s signature) on this form is included. No signature is required

Attach this certificate to the invoice(s) or delivery ticket(s) covering

if the seller is a registered distributor of motor fuel pursuant to

the above purchase and keep these documents as part of your

Article 12-A of the Tax Law. This alternative document must also

records for a three-year period.

state I certify that the amount of tax shown has been or will be

Failure to obtain and keep a copy of this certificate for each

paid by me or my supplier or, if no motor fuel tax, petroleum

purchase of motor fuel from a supplier will subject you to liability for

business tax, or sales tax is shown, I certify that no such taxes

motor fuel taxes on that purchase.

are being charged on the motor fuel based on an exemption.

Need help?

Telephone assistance is available from 8 a.m. to

Hotline for the hearing and speech impaired:

5:55 p.m. (eastern time), Monday through Friday.

1 800 634-2110 from 8 a.m. to 5:55 p.m. (eastern time),

Monday through Friday. If you do not own a

For business tax information:

1 800 972-1233

telecommunications device for the deaf (TDD), check with

For general information:

1 800 225-5829

independent living centers or community action programs to

find out where machines are available for public use.

To order forms and publications:

1 800 462-8100

(Also see Internet access below.)

Persons with disabilities: In compliance with the

From areas outside the U.S. and

Americans with Disabilities Act, we will ensure that our

lobbies, offices, meeting rooms, and other facilities are

outside Canada:

(518) 485-6800

accessible to persons with disabilities. If you have

Fax-on-demand forms: Forms are

questions about special accommodations for persons

available 24 hours a day,

with disabilities, please call 1 800 225-5829.

7 days a week.

1 800 748-3676

If you need to write, address your letter to:

NYS TAX DEPARTMENT

Internet access:

TAXPAYER CONTACT CENTER

W A HARRIMAN CAMPUS

ALBANY NY 12227

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2