SC990-T

Page 2

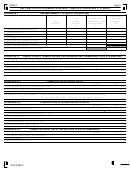

SCHEDULE A AND B

ADDITIONS TO FEDERAL TAXABLE INCOME

1. Taxes on or Measured By Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2. Federal Net Operating Loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3.

3.

4.

4.

5. Other Additions (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Total Additions (add lines 1 through 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

DEDUCTIONS FROM FEDERAL TAXABLE INCOME

7. Interest On Obligations Of The U.S. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8.

8.

9.

9.

10. Other Deductions (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

11. Total Deductions (add lines 7 through 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

12. Net Adjustment (line 6 less line 11) Also enter on line 2, Page 1, SC990-T . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.

SCHEDULE C

SUMMARY OF INCOME TAX CREDITS (FROM SC1120-TC)

1. Credit Carryover From Previous Year's SC990-T, Schedule C

1.

(NOTE:

Should agree to SC1120-TC Column A, line 16). .

2. Enter Total Credits from SC1120-TC, Column B, line 16. SC1120-TC must be attached to return.. . . . . . . . .

2.

3. Total Credits (add lines 1 and 2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4. Tax (line 7, SC990-T) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. Lesser of line 3 or 4 (enter on line 8, SC990-T)

(NOTE: Should agree to SC1120-TC, Column C, line 16.) . . . . . . .

5.

6. Enter Credits Lost Due to Statute

. . . . . . . . . . . . . . . . .

6.

(NOTE: Should agree to SC1120-TC, Column D, line 16.) .

7. Credit Carryover (line 3 less line 5 and 6)

(NOTE: Should agree to SC1120-TC, Column E, line 16.)

. . . . . . . . . . . .

7.

SCHEDULE D

RESERVED

SCHEDULE E

RESERVED

I, the undersigned, a principal officer of the corporation for which this return is made declare that this return, including accompanying

Please

Annual Report, statements and schedules, has been examined by me and is to the best of my knowledge and belief, a true and

Sign

complete return.

Here

Signature of officer

Officer's title

Officer's printed name

Date

Telephone Number

Preparer's Printed Name

I authorize the Director of the Department of Revenue or delegate to

discuss this return, attachments and related tax matters with the preparer.

Yes

No

Date

Preparer's Telephone Number

Preparer's

Check if

Paid

signature

self-employed

Preparer's

Firm's name (or

PTIN or FEIN

Use Only

yours if self-employed)

ZIP Code

and address

If this is an organization's final return, signing here authorizes the Department of Revenue to disclose that information with the

Secretary of State. You must close with the Secretary of State as well as the Department of Revenue.

Taxpayer's Signature

Date

33152026

1

1 2

2 3

3 4

4