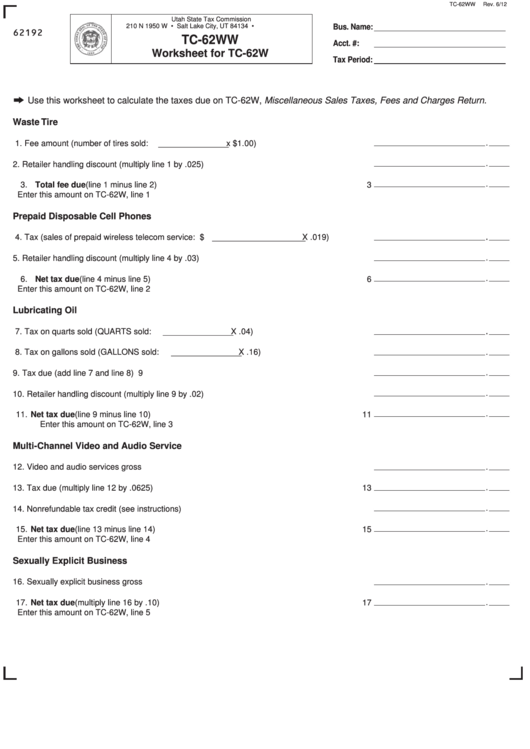

TC-62WW

Rev. 6/12

Utah State Tax Commission

210 N 1950 W • Salt Lake City, UT 84134 • tax.utah.gov

Bus. Name:

62192

TC-62WW

Acct. #:

Worksheet for TC-62W

Tax Period:

Use this worksheet to calculate the taxes due on TC-62W, Miscellaneous Sales Taxes, Fees and Charges Return.

Waste Tire

1. Fee amount (number of tires sold: __ __ _ __ __ x $1.00) ........................................

1

2. Retailer handling discount (multiply line 1 by .025) ............................................................

2

3. Total fee due (line 1 minus line 2) .....................................................................................

3

...........................................................................................................................................

...........................................................................................................................................

Enter this amount on TC-62W, line 1

Prepaid Disposable Cell Phones

4. Tax (sales of prepaid wireless telecom service: $____________ X .019) ........

4

5. Retailer handling discount (multiply line 4 by .03) ..............................................................

5

6. Net tax due (line 4 minus line 5)........................................................................................

6

...........................................................................................................................................

...........................................................................................................................................

Enter this amount on TC-62W, line 2

Lubricating Oil

7. Tax on quarts sold (QUARTS sold: _ __ __ _ __ _ X .04) .........................................

7

8. Tax on gallons sold (GALLONS sold: _ _ __ __ _ __ X .16) ......................................

8

9. Tax due (add line 7 and line 8) ...........................................................................................

9

10. Retailer handling discount (multiply line 9 by .02) ..............................................................

10

11. Net tax due (line 9 minus line 10)......................................................................................

11

...........................................................................................................................................

...........................................................................................................................................

Enter this amount on TC-62W, line 3

Multi-Channel Video and Audio Service

12. Video and audio services gross receipts............................................................................

12

13. Tax due (multiply line 12 by .0625).....................................................................................

13

14. Nonrefundable tax credit (see instructions)........................................................................

14

15. Net tax due (line 13 minus line 14)....................................................................................

15

...........................................................................................................................................

...........................................................................................................................................

Enter this amount on TC-62W, line 4

Sexually Explicit Business

16. Sexually explicit business gross receipts ...........................................................................

16

17. Net tax due (multiply line 16 by .10) ..................................................................................

17

...........................................................................................................................................

...........................................................................................................................................

Enter this amount on TC-62W, line 5

1

1 2

2