Form Tc-583 - Nonresident Affidavit For Sales Tax Exemption

ADVERTISEMENT

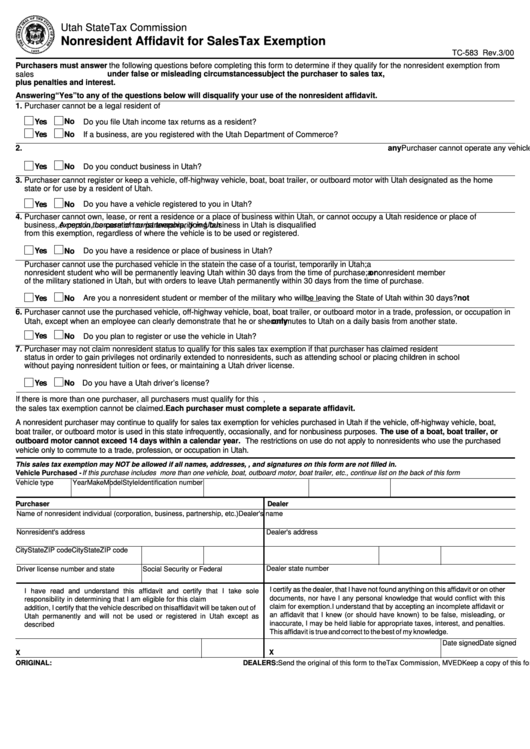

Utah State Tax Commission

Nonresident Affidavit for Sales Tax Exemption

TC-583 Rev. 3/00

Purchasers must answer

the following questions before completing this form to determine if they qualify for the nonresident exemption from

sales tax. Completing this affidavit

under false or misleading circumstances

will void this affidavit and

subject the purchaser to sales tax,

plus penalties and interest.

Answering “Yes” to any of the questions below will disqualify your use of the nonresident affidavit.

1. Purchaser cannot be a legal resident of Utah. The fact that a person leaves the state temporarily does not terminate his or her Utah residency.

No

Yes

Do you file Utah income tax returns as a resident?

Yes

No

If a business, are you registered with the Utah Department of Commerce?

2.

Purchaser cannot operate any vehicle, off-highway vehicle, boat, boat trailer, or outboard motor as part of

any

business within Utah.

Yes

Do you conduct business in Utah?

No

3. Purchaser cannot register or keep a vehicle, off-highway vehicle, boat, boat trailer, or outboard motor with Utah designated as the home

state or for use by a resident of Utah.

Yes

No

Do you have a vehicle registered to you in Utah?

4. Purchaser cannot own, lease, or rent a residence or a place of business within Utah, or cannot occupy a Utah residence or place of

except in the case of tourist temporarily in Utah

business,

. A person, corporation or partnership, doing business in Utah is disqualified

from this exemption, regardless of where the vehicle is to be used or registered.

Yes

No

Do you have a residence or place of business in Utah?

5.

Purchaser cannot use the purchased vehicle in the state

except

in the case of a tourist, temporarily in Utah;

or

a

nonresident student who will be permanently leaving Utah within 30 days from the time of purchase;

or

a nonresident member

of the military stationed in Utah, but with orders to leave Utah permanently within 30 days from the time of purchase.

Yes

No

Are you a nonresident student or member of the military who will

not

be leaving the State of Utah within 30 days?

6.

Purchaser cannot use the purchased vehicle, off-highway vehicle, boat, boat trailer, or outboard motor in a trade, profession, or occupation in

Utah, except when an employee can clearly demonstrate that he or she

only

commutes to Utah on a daily basis from another state.

Yes

No

Do you plan to register or use the vehicle in Utah?

7. Purchaser may not claim nonresident status to qualify for this sales tax exemption if that purchaser has claimed resident

status in order to gain privileges not ordinarily extended to nonresidents, such as attending school or placing children in school

without paying nonresident tuition or fees, or maintaining a Utah driver license.

Do you have a Utah driver’s license?

Yes

No

If there is more than one purchaser, all purchasers must qualify for this exemption. If any of the purchasers do not qualify,

the sales tax exemption cannot be claimed. Each purchaser must complete a separate affidavit.

A nonresident purchaser may continue to qualify for sales tax exemption for vehicles purchased in Utah if the vehicle, off-highway vehicle, boat,

boat trailer, or outboard motor is used in this state infrequently, occasionally, and for nonbusiness purposes.

The use of a boat, boat trailer, or

outboard motor cannot exceed 14 days within a calendar year.

The restrictions on use do not apply to nonresidents who use the purchased

vehicle only to commute to a trade, profession, or occupation in Utah.

This sales tax exemption may NOT be allowed if all names, addresses, I.D. numbers, and signatures on this form are not filled in.

Vehicle Purchased - If this purchase includes more than one vehicle, boat, outboard motor, boat trailer, etc., continue list on the back of this form

Vehicle type

Year

Make

Model

Style

Identification number

Purchaser

Dealer

Name of nonresident individual (corporation, business, partnership, etc.)

Dealer's name

Nonresident's address

Dealer's address

City

State

ZIP code

City

State

ZIP code

Dealer state number

Driver license number and state

Social Security or Federal I.D. number

I certify as the dealer, that I have not found anything on this affidavit or on other

I have read and understand this affidavit and certify that I take sole

documents, nor have I any personal knowledge that would conflict with this

responsibility in determining that I am eligible for this claim of exemption. In

claim for exemption. I understand that by accepting an incomplete affidavit or

addition, I certify that the vehicle described on this affidavit will be taken out of

an affidavit that I knew (or should have known) to be false, misleading, or

Utah permanently and will not be used or registered in Utah except as

inaccurate, I may be held liable for appropriate taxes, interest, and penalties.

described above.This affidavit is true and correct to the best of my knowledge.

This affidavit is true and correct to the best of my knowledge.

Date signed

Date signed

X

X

ORIGINAL:

Send the original of this form to the Tax Commission, MVED

DEALERS:

Keep a copy of this form for your record

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2