Form C-268 - Certificate Of Tax Compliance Request Form Page 2

ADVERTISEMENT

General Information

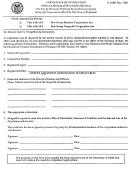

A Certificate of Compliance is prima facie evidence that a taxpayer has filed all returns or paid its taxes, based on all

information available.

The Certificate of Compliance is valid for 30 days following date of issue by this department.

NOTE:

The Certificate of Compliance request should be processed within 10 business days of receipt by the Tax

Compliance Officer.

For any questions, call 803-898-5381, or see SC Revenue Procedure #03-5 for more information.

Instructions

This certificate will not replace the Estate Tax Closing Letter.

Purpose of Form. This form is used to request a Certificate of Tax Compliance letter to establish that a taxpayer has filed all

returns based on all information available.

Filing the Request. Mail your request to the Department at the address listed below.

SOUTH CAROLINA DEPARTMENT OF REVENUE

TAX COMPLIANCE OFFICER

COLUMBIA, SOUTH CAROLINA 29214-0027

If you are sending your request by any type express mail courier service, send it to:

SOUTH CAROLINA DEPARTMENT OF REVENUE

TAX COMPLIANCE OFFICER

300A OUTLET POINTE BLVD

COLUMBIA, SOUTH CAROLINA 29214

Specific Instructions

Section 1 - Requestor Information. Enter the name, current mailing address, daytime telephone number and fax number of

the person making the request.

Section 2 - Taxpayer Information. Enter the full name of the taxpayer as shown on the tax return, current mailing address,

and applicable identification numbers. The taxpayer's federal employer identification number or social security number is

required on all requests. If the entity is disregarded, the Certificate of Compliance will be issued in the name of the

owner.

Section 3 - Person to Receive Certificate. Indicate on this form the person(s) to receive the Response. The response can be

mailed to the taxpayer or to anyone authorized by the taxpayer to receive this information. The results may be sent to the

authorized person by fax only when authorized by the original request. Enter the full name and address of the person to

receive the response. If more than one person is to receive the information, attach a list of the full names and addresses of the

persons to receive this request.

Section 4 - Payment. A non-refundable administrative fee of $60.00 should be attached to the application. Failure to attach

the payment will cause a delay in processing your request. (Faxed request cannot be processed). Each business requires a

separate request and payment.

A Certificate of Tax Compliance will indicate that the taxpayer has filed all returns and paid all taxes through the periods

indicated based on information available. If a taxpayer is not in compliance, then (1) the Department will inform the taxpayer of

the reasons for non-compliance, and/or (2) the Department will send a letter stating that the taxpayer is not in compliance to the

party indicated in Section 3 of this form.

Signature of Requestor

Individuals. If a joint return is involved, either spouse may sign the request.

Corporations. Generally, this request can be signed by: (1) an officer having legal authority to bind the corporation, or (2)

any person designated by the board of directors or other governing body.

Partnership or LLC. Generally, this request can be signed by a general partner or member of the LLC.

*Other Requestor. You must sign and date the request. A valid power of attorney must be signed by the taxpayer and

attached to this request. If the power of attorney is not properly signed and dated, your request will be returned.

62072012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2