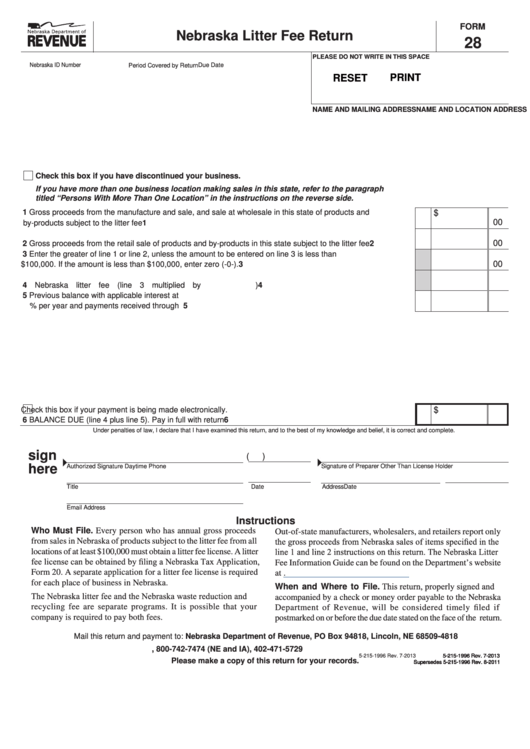

FORM

Nebraska Litter Fee Return

28

PLEASE DO NOT WRITE IN THIS SPACE

Nebraska ID Number

Due Date

Period Covered by Return

RESET

PRINT

NAME AND LOCATION ADDRESS

NAME AND MAILING ADDRESS

Check this box if you have discontinued your business.

If you have more than one business location making sales in this state, refer to the paragraph

titled “Persons With More Than One Location” in the instructions on the reverse side.

1 Gross proceeds from the manufacture and sale, and sale at wholesale in this state of products and

$

00

by-products subject to the litter fee .....................................................................................................................

1

00

2 Gross proceeds from the retail sale of products and by-products in this state subject to the litter fee ................

2

3 Enter the greater of line 1 or line 2, unless the amount to be entered on line 3 is less than

00

$100,000. If the amount is less than $100,000, enter zero (-0-). ..........................................................................

3

4 Nebraska litter fee (line 3 multiplied by

) ......................................................................................

4

5 Previous balance with applicable interest at

% per year and payments received through

5

Check this box if your payment is being made electronically.

$

6 BALANCE DUE (line 4 plus line 5). Pay in full with return ....................................................................................

6

Under penalties of law, I declare that I have examined this return, and to the best of my knowledge and belief, it is correct and complete.

sign

(

)

here

Authorized Signature

Daytime Phone

Signature of Preparer Other Than License Holder

Title

Date

Address

Date

Email Address

Instructions

Who Must File. Every person who has annual gross proceeds

Out-of-state manufacturers, wholesalers, and retailers report only

the gross proceeds from Nebraska sales of items specified in the

from sales in Nebraska of products subject to the litter fee from all

line 1 and line 2 instructions on this return. The Nebraska Litter

locations of at least $100,000 must obtain a litter fee license. A litter

fee license can be obtained by filing a Nebraska Tax Application,

Fee Information Guide can be found on the Department’s website

Form 20. A separate application for a litter fee license is required

at

for each place of business in Nebraska.

When and Where to File. This return, properly signed and

The Nebraska litter fee and the Nebraska waste reduction and

accompanied by a check or money order payable to the Nebraska

recycling fee are separate programs. It is possible that your

Department of Revenue, will be considered timely filed if

company is required to pay both fees.

postmarked on or before the due date stated on the face of the return.

Mail this return and payment to: Nebraska Department of Revenue, PO Box 94818, Lincoln, NE 68509-4818

, 800-742-7474 (NE and IA), 402-471-5729

5-215-1996 Rev. 7-2013

5-215-1996 Rev. 7-2013

5-215-1996 Rev. 7-2013

5-215-1996 Rev. 7-2013

5-215-1996 Rev. 7-2013

Please make a copy of this return for your records.

Supersedes 5-215-1996 Rev. 8-2011

Supersedes 5-215-1996 Rev. 8-2011

Supersedes 5-215-1996 Rev. 8-2011

Supersedes 5-215-1996 Rev. 8-2011

Supersedes 5-215-1996 Rev. 8-2011

1

1 2

2