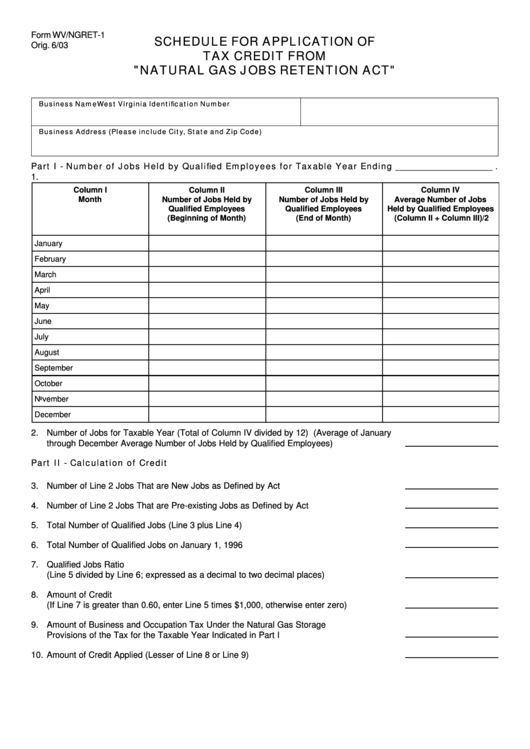

Form WV/NGRET-1

SCHEDULE FOR APPLICATION OF

Orig. 6/03

TAX CREDIT FROM

"NATURAL GAS JOBS RETENTION ACT"

Business Name

West Virginia Identification Number

Business Address (Please include City, State and Zip Code)

Part I - Number of Jobs Held by Qualified Employees for Taxable Year Ending ______________________ .

1.

Column I

Column II

Column III

Column IV

Month

Number of Jobs Held by

Number of Jobs Held by

Average Number of Jobs

Qualified Employees

Qualified Employees

Held by Qualified Employees

(Beginning of Month)

(End of Month)

(Column II + Column III)/2

January

February

March

April

May

June

July

August

September

October

November

December

2. Number of Jobs for Taxable Year (Total of Column IV divided by 12) (Average of January

through December Average Number of Jobs Held by Qualified Employees) .............................

Part II - Calculation of Credit

3. Number of Line 2 Jobs That are New Jobs as Defined by Act ...................................................

4. Number of Line 2 Jobs That are Pre-existing Jobs as Defined by Act .......................................

5. Total Number of Qualified Jobs (Line 3 plus Line 4) ...................................................................

6. Total Number of Qualified Jobs on January 1, 1996 ...................................................................

7. Qualified Jobs Ratio

(Line 5 divided by Line 6; expressed as a decimal to two decimal places) ................................

8. Amount of Credit

(If Line 7 is greater than 0.60, enter Line 5 times $1,000, otherwise enter zero) .......................

9. Amount of Business and Occupation Tax Under the Natural Gas Storage

Provisions of the Tax for the Taxable Year Indicated in Part I ...................................................

10. Amount of Credit Applied (Lesser of Line 8 or Line 9) ................................................................

1

1 2

2