Instructions For Form Rct-131 - Gross Receipts Tax Report - Private Banker Page 4

ADVERTISEMENT

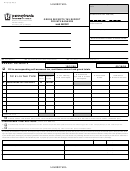

RCT-131 – Line-by-Line Instruction

RCT-131-I (1-15)

Page 4 of 4

RCT-131 should be completed in the following order:

Step 1 - Complete the taxpayer information section and any applicable questions at the top of Page 1.

Step 2 - Enter the Revenue ID number and other taxpayer information in the designated fields at the top of each page.

Step 3 - Complete Page 2, Gross Receipts From the Following Sources.

Step 4 - Complete Page 1, Tax Liability, Payment and Overpayment sections.

Step 5 - Complete the corporate officer information section, sign and date at the bottom of Page 1.

Step 6 - Complete the preparer’s information section, sign and date at the bottom of Page 3, if applicable.

Step 7 - Mail the completed report and any supporting schedules to the PA Department of Revenue.

Page 2 - Gross Receipts From The Following Sources:

Line 1 - Enter commissions on loans and various banking services.

Line 2 - Enter discounts on loans.

Line 3 - Enter abatements and allowances.

Line 4 - Enter banking charges or fees on depositor’s accounts.

Line 5 - Enter rents on real estate owned.

Line 6 - Interest

a. Enter interest received on bonds of public and private corporations.

b. Enter interest received on bonds of states other than the Commonwealth of Pennsylvania.

c. Enter interest received on bonds issued by municipal subdivisions of the Commonwealth of Pennsylvania.

d. Enter interest received on loans.

e. Enter interest received on mortgages and judgments.

f. Enter interest received on drawing accounts or overdrafts of partners.

g. Enter interest received on balances with other banks.

h. Total Interest

Enter the total of Lines 6a through 6g.

i. Enter the amortization of premiums.

j. Interest less Amortization

Enter the difference of Line 6h minus Line 6i.

Line 7 - Enter dividends received on stock.

Line 8 - Purchases & Sales of Securities

a. Enter profits on purchases and sales of securities for investment or trading purposes.

b. Enter losses on purchases and sales of securities for investment or trading purposes.

c. Profits less Losses

Enter the difference of Line 8a minus Line 8b.

Line 9 - Rentals of Safe-Deposit Boxes

Enter receipts from rentals of safe-deposit boxes.

Line 10 - Other Receipts

Enter receipts from other sources on Lines 10a through 10d. If additional space is needed, provide a detailed schedule. Enter the total

of all receipts on Line 10e.

Line 11 - Total Gross Receipts

Enter the total of Lines 1 through 10.

Note: Interest on US obligations and interest on PA obligations is not taxable.

Line 12 - Tax

Multiply Line 11 by 0.01. Carry the tax to RCT-131, Page 1, Line 1.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4