Form U00023 - Memorandum On Employer Liability

ADVERTISEMENT

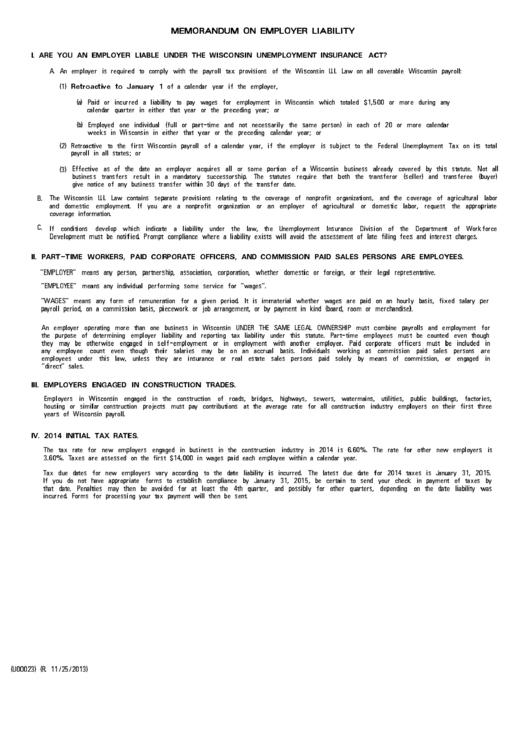

MEMORANDUM ON EMPLOYER LIABILITY

I.

ARE

YOU

AN

EMPLOYER

LIABLE

UNDER

THE

WISCONSIN

UNEMPLOYMENT INSURANCE

ACT?

A.

An

employer

is

required

to

comply

with

the

payroll

tax

provisions

of

the

Wisconsin

U.I.

Law

on

all

coverable

Wisconsin

payroll:

Retroactive

to

January

1

(1)

of

a

calendar

year

if

the

employer,

(a)

Paid

or

incurred

a

liability

to

pay

wages

for

employment

in

Wisconsin

which

totaled

$1,500

or

more

during

any

calendar

quarter

in

either

that

year

or

the

preceding

year;

or

(b)

Employed

one

individual

(full

or

part-time

and

not

necessarily

the

same

person)

in

each

of

20

or

more

calendar

weeks

in

Wisconsin

in

either

that

year

or

the

preceding

calendar

year;

or

(2)

Retroactive

to

the

first

Wisconsin

payroll

of

a

calendar

year,

if

the

employer

is

subject

to

the

Federal

Unemployment

Tax

on

its

total

payroll in all states; or

Effective

as

of

the

date

an

employer

acquires

all

or

some

portion

of

a

Wisconsin

business

already

covered

by

this

statute.

Not

all

(3)

business

transfers

result

in

a

mandatory

successorship.

The

statutes

require

that

both

the

transferor

(seller)

and

transferee

(buyer)

give notice of any business transfer within 30 days of the transfer date.

The

Wisconsin

U.I.

Law

contains

separate

provisions

relating

to

the

coverage

of

nonprofit

organizations,

and

the

coverage

of

agricultural

labor

B.

and

domestic

employment.

If

you

are

a

nonprofit

organization

or

an

employer

of

agricultural

or

domestic

labor,

request

the

appropriate

coverage information.

C.

If

conditions

develop

which

indicate

a

liability

under

the

law,

the

Unemployment

Insurance

Division

of

the

Department

of

Workforce

Development must be notified. Prompt compliance where a liability exists will avoid the assessment of late filing fees and interest charges.

II.

PART-TIME

WORKERS,

PAID

CORPORATE

OFFICERS,

AND

COMMISSION

PAID

SALES

PERSONS

ARE

EMPLOYEES.

"EMPLOYER"

means

any

person,

partnership,

association,

corporation,

whether

domestic

or

foreign,

or

their

legal

representative.

"EMPLOYEE"

means

any

individual

performing

some

service

for

"wages".

"WAGES"

means

any

form

of

remuneration

for

a

given

period.

It

is

immaterial

whether

wages

are

paid

on

an

hourly

basis,

fixed

salary

per

payroll period, on a commission basis, piecework or job arrangement, or by payment in kind (board, room or merchandise).

An

employer

operating

more

than

one

business

in

Wisconsin

UNDER

THE

SAME

LEGAL

OWNERSHIP

must

combine

payrolls

and

employment

for

the

purpose

of

determining

employer

liability

and

reporting

tax

liability

under

this

statute.

Part-time

employees

must

be

counted

even

though

they

may

be

otherwise

engaged

in

self-employment

or

in

employment

with

another

employer.

Paid

corporate

officers

must

be

included

in

any

employee

count

even

though

their

salaries

may

be

on

an

accrual

basis.

Individuals

working

as

commission

paid

sales

persons

are

employees

under

this

law,

unless

they

are

insurance

or

real

estate

sales

persons

paid

solely

by

means

of

commission,

or

engaged

in

"direct" sales.

III.

EMPLOYERS

ENGAGED

IN

CONSTRUCTION

TRADES.

Employers

in

Wisconsin

engaged

in

the

construction

of

roads,

bridges,

highways,

sewers,

watermains,

utilities,

public

buildings,

factories,

housing

or

similar

construction

projects

must

pay

contributions

at

the

average

rate

for

all

construction

industry

employers

on

their

first

three

years of Wisconsin payroll.

IV.

2014 INITIAL TAX RATES.

The

tax

rate

for

new

employers

engaged

in

business

in

the

construction

industry

in

2014

is

6.60%.

The

rate

for

other

new

employers

is

3.60%. Taxes are assessed on the first $14,000 in wages paid each employee within a calendar year.

Tax

due

dates

for

new

employers

vary

according

to

the

date

liability

is

incurred.

The

latest

due

date

for

2014

taxes

is

January

31,

2015.

If

you

do

not

have

appropriate

forms

to

establish

compliance

by

January

31,

2015,

be

certain

to

send

your

check

in

payment

of

taxes

by

that

date.

Penalties

may

then

be

avoided

for

at

least

the

4th

quarter,

and

possibly

for

other

quarters,

depending

on

the

date

liability

was

incurred. Forms for processing your tax payment will then be sent.

(U00023) (R. 11/25/2013)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2