Form 4902 - Michigan Corporate Income Tax Schedule Of Recapture Of Certain Business Tax Credits - 2012 Page 13

ADVERTISEMENT

○ Worksheet 4b, columns A and B: Leave lines blank.

from line 8, column M to Worksheet 4a, line 4, column

E for each appropriated tax year line.

○ Worksheet 4a, Column E: Enter results from the

• Method C:

taxpayer’s own software of choice (that is, a non-Treasury

Web tool) or the taxpayer’s own calculation that reflects

○ Worksheet 4a, columns A through D: Leave lines

the MBT statute. Retain records to substantiate figures

blank.

entered in the filed return.

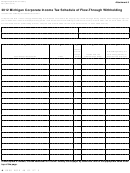

Worksheet 4a

A

B

C

D

E

4.

Maximum or

Actual Calculated

Effective

Return For

Recapture

Taxable Year

Net Capital Investment

SBT ITC

SBT ITC Used

Percentage Rate

Ending

(C-8000ITC, Line 24)

(C-8000ITC, Line 33)

(C-8000ITC, Line 36)

of SBT ITC by Year

(MM-DD-YYYY)

%

%

%

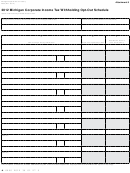

Worksheet 4b

5.

A

B

Return For

Taxable Year

SBT ITC Carryforward Used

Ending

(Form 4569, line 3)

(MM-DD-YYYY)

Worksheet 4c

6.

A

B

C

D

Taxable Year

(End Date)

SBT ITC Credit Rate

In Which Disposed

SBT Capital

Divide line 4, column C,

Gross SBT ITC Credit Amount

Asset Were Acquired

Investment Amount

by line 4, column B

Multiply column B

(MM-DD-YYY)

(C-8000ITC, line 10)

(See Instructions if zero)

by column C

7.

E

F

G

H

Taxable Year

SBT Recapture Capital

SBT Recapture Amount Offset

(repeat from

Investment Amount

Gross SBT ITC Credit Recapture

by Credit

column A)

(C-8000ITC, line 23)

Multiply column F by column C

Lesser of columns D and G

8.

I

J

K

L

M

SBT ITC Recapture Rate

Extent Credit Used Rate

Multiply columns C

Taxable Year

SBT ITC Credit Amount

Divide column K by

and L. Carry amount to

(repeat from

That offsets SBT liability

Total SBT ITC Credit Amount Used

column D (cannot be

Worksheet 4a, line 4,

column A)

(from webtool)

Add columns J and H

more than 1)

column E

79

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14