Form 4902 - Michigan Corporate Income Tax Schedule Of Recapture Of Certain Business Tax Credits - 2012 Page 6

ADVERTISEMENT

with MEGA, the taxpayer shall have a percentage of the

Line 21: Enter the calculated recapture amount of all MEGA

amount previously claimed added back to the tax liability of the

Advanced Lithium Ion Battery Pack Credits claimed on

previously filed 4584 forms, as applicable.

taxpayer in the tax year that the taxpayer fails to comply with

the agreement, and shall have its credit terminated or reduced

Include completed Form 4902 as part of the tax return filing.

prospectively.

Calculation of MBT ITC Credit Recapture Amount

taxable income (as defined for MBT purposes) in the year of the

Calculation of MBT ITC Credit Recapture Bases

sale. The gain attributable to the installment sale that is reported

For each category of asset disposed (or moved out of

in subsequent years increases the credit base (or reduces other

Michigan) that triggers an MBT ITC credit recapture, enter the

information requested below.

sources of recapture) for those years, and must be reported on

column C of the appropriate Worksheet based on the type of

In each category of disposed/moved asset, group assets by

asset. For property placed in service prior to January 1, 2008,

taxable year in which they were acquired. All events that have

gain reflected in federal taxable income (as defined for MBT

varying dates must be listed separately. Multiple dispositions

purposes) is equal to the gain reported for federal purposes.

(or transfers) may be combined as one entry, subject to the

UBGs: The recapture of capital investments for UBGs is

following: all combined events must satisfy the terms of

calculated on combined assets of standard members of the

the table in which they are entered. “Taxable Year in which

disposed assets were acquired” must be the same for all events

UBG. Assets transferred between members of the group are

not a capital investment in qualifying assets for purposes

combined on a single line.

of calculating this credit or its recapture. Disposing of or

UBGs: If capital asset subject to recapture is from a member

transferring an asset outside of the UBG triggers recapture.

that was not part of the group in the tax year the asset was

Also, moving an asset outside of Michigan creates recapture,

acquired, make a separate line entry for the tax year the

even if the transfer is to a member of the UBG.

member filed outside of the group. Take care to report in this

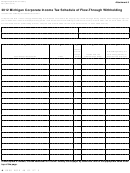

Worksheet 1a — Depreciable Tangible Assets

line information requested in each column only from the

member’s single filings, not the group’s.

Enter all dispositions of depreciable tangible assets located

in Michigan that were acquired or moved into Michigan after

NOTE: A sale of qualifying property reported on the

acquisition in a tax year beginning after 2007 and were sold

installment method for federal income tax purposes causes

or otherwise disposed of during the current filing period.

a recapture based upon the entire sale price in the year of the

Give all information required for each disposition in columns

sale. The recapture is reduced by any gain reported in federal

Worksheet 1a — Depreciable Tangible Assets

A

B

C

D

E

F

MBT Apportionment

Apportioned

SBT ITC Recapture

Taxable Year (End Date)

Combined Sales Price

Percentage from Form

Gain/Loss

(Base 1)

In Which Disposed

of Disposed Assets by

Net Gain/Loss From

4891, line 9g, or Form

Assets Were Acquired

Multiply Column C

Subtract Column E

Year of Acquisition

Sale of Assets

4908, line 9c

(MM-DD-YYYY)

by Column D

From Column B

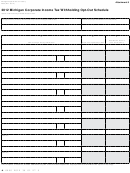

Worksheet 1b — Depreciable Mobile Tangible Assets

A

B

C

D

E

F

MBT Apportionment

SBT ITC Recapture

Taxable Year (End Date)

Combined Sales Price of

Percentage from Form

(Base 2)

Adjusted Proceeds

In Which Disposed

Disposed Assets by

Net Gain/Loss From

4891, line 9g, or Form

Multiply Column D

Assets Were Acquired

Subtract Column C

Year of Acquisition

Sale of Assets

4908, line 9c

by Column E

(MM-DD-YYYY)

From Column B

Worksheet 1c — Assets Transferred Outside Michigan

B

A

SBT ITC Recapture

Taxable Year (End Date)

Combined Adjusted Federal Basis of

In Which Disposed

Disposed Assets by Year of Acquisition

Assets Were Acquired

(Base 3)

(MM-DD-YYYY)

72

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14