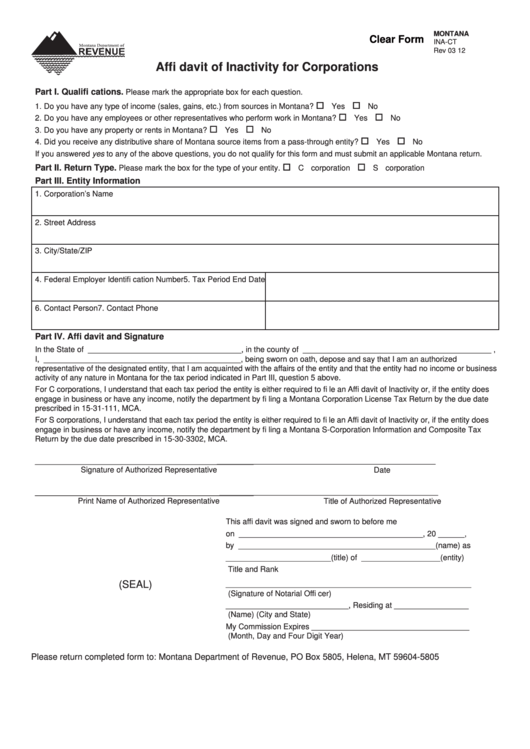

MONTANA

Clear Form

INA-CT

Rev 03 12

Affi davit of Inactivity for Corporations

Part I. Qualifi cations.

Please mark the appropriate box for each question.

1. Do you have any type of income (sales, gains, etc.) from sources in Montana?

Yes

No

2. Do you have any employees or other representatives who perform work in Montana?

Yes

No

3. Do you have any property or rents in Montana?

Yes

No

4. Did you receive any distributive share of Montana source items from a pass-through entity?

Yes

No

If you answered yes to any of the above questions, you do not qualify for this form and must submit an applicable Montana return.

Part II. Return Type.

Please mark the box for the type of your entity.

C corporation

S corporation

Part III. Entity Information

1. Corporation’s Name

2. Street Address

3. City/State/ZIP

4. Federal Employer Identifi cation Number

5. Tax Period End Date

6. Contact Person

7. Contact Phone

Part IV. Affi davit and Signature

In the State of ___________________________________ , in the county of ___________________________________________ ,

I, _____________________________________________ , being sworn on oath, depose and say that I am an authorized

representative of the designated entity, that I am acquainted with the affairs of the entity and that the entity had no income or business

activity of any nature in Montana for the tax period indicated in Part III, question 5 above.

For C corporations, I understand that each tax period the entity is either required to fi le an Affi davit of Inactivity or, if the entity does

engage in business or have any income, notify the department by fi ling a Montana Corporation License Tax Return by the due date

prescribed in 15-31-111, MCA.

For S corporations, I understand that each tax period the entity is either required to fi le an Affi davit of Inactivity or, if the entity does

engage in business or have any income, notify the department by fi ling a Montana S-Corporation Information and Composite Tax

Return by the due date prescribed in 15-30-3302, MCA.

______________________________________________

______________________________________________

Signature of Authorized Representative

Date

______________________________________________

______________________________________________

Print Name of Authorized Representative

Title of Authorized Representative

This affi davit was signed and sworn to before me

on __________________________________________ , 20 ______ ,

by _____________________________________________ (name) as

________________________ (title) of __________________ (entity)

Title and Rank

(SEAL)

________________________________________________________

(Signature of Notarial Offi cer)

____________________________ , Residing at _________________

(Name)

(City and State)

My Commission Expires ____________________________________

(Month, Day and Four Digit Year)

Please return completed form to: Montana Department of Revenue, PO Box 5805, Helena, MT 59604-5805

1

1 2

2