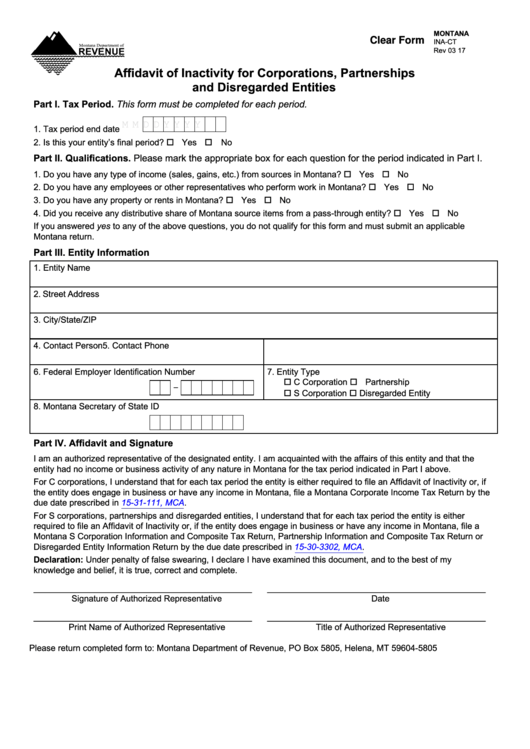

MONTANA

Clear Form

INA-CT

Rev 03 17

Affidavit of Inactivity for Corporations, Partnerships

and Disregarded Entities

Part I. Tax Period. This form must be completed for each period.

M M D D Y Y Y Y

1. Tax period end date

2. Is this your entity’s final period? Yes

No

Part II. Qualifications. Please mark the appropriate box for each question for the period indicated in Part I.

1. Do you have any type of income (sales, gains, etc.) from sources in Montana?

Yes

No

2. Do you have any employees or other representatives who perform work in Montana?

Yes

No

3. Do you have any property or rents in Montana?

Yes

No

4. Did you receive any distributive share of Montana source items from a pass-through entity?

Yes

No

If you answered yes to any of the above questions, you do not qualify for this form and must submit an applicable

Montana return.

Part III. Entity Information

1. Entity Name

2. Street Address

3. City/State/ZIP

4. Contact Person

5. Contact Phone

6. Federal Employer Identification Number

7. Entity Type

C Corporation

Partnership

-

S Corporation

Disregarded Entity

8. Montana Secretary of State ID

Part IV. Affidavit and Signature

I am an authorized representative of the designated entity. I am acquainted with the affairs of this entity and that the

entity had no income or business activity of any nature in Montana for the tax period indicated in Part I above.

For C corporations, I understand that for each tax period the entity is either required to file an Affidavit of Inactivity or, if

the entity does engage in business or have any income in Montana, file a Montana Corporate Income Tax Return by the

due date prescribed in

15-31-111,

MCA.

For S corporations, partnerships and disregarded entities, I understand that for each tax period the entity is either

required to file an Affidavit of Inactivity or, if the entity does engage in business or have any income in Montana, file a

Montana S Corporation Information and Composite Tax Return, Partnership Information and Composite Tax Return or

Disregarded Entity Information Return by the due date prescribed in

15-30-3302,

MCA.

Declaration: Under penalty of false swearing, I declare I have examined this document, and to the best of my

knowledge and belief, it is true, correct and complete.

______________________________________________

______________________________________________

Signature of Authorized Representative

Date

______________________________________________

______________________________________________

Print Name of Authorized Representative

Title of Authorized Representative

Please return completed form to: Montana Department of Revenue, PO Box 5805, Helena, MT 59604-5805

1

1