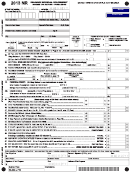

NR

2013 DELAWARE NON-RESIDENT FORM 200-02, PAGE 2

2013

Page 2

*DF20313029999*

Delaware Source

Federal

Income/Loss

COLUMN 1

SECTION A - INCOME AND ADJUSTMENTS FROM FEDERAL RETURN

COLUMN 2

1

1.

Wages, salaries, tips, etc...........................................................................................................................................

00

00

2.

Interest...........................................................................................................................................................................

2

00

00

3

3.

Dividends.......................................................................................................................................................................

00

00

4.

State refunds, credits or offsets of state & local income taxes.............................................................................

4

00

00

5.

Alimony received...........................................................................................................................................................

5

00

00

6.

Business income or (loss) (See instructions on Page 6)....................................................................................

6

00

00

7a. Capital gain or (loss)...................................................................................................................................................

7a

00

00

7b. Other gains or (losses)...............................................................................................................................................

7b

00

00

8.

IRA distributions............................................................................................................................................................

8

00

00

9.

Taxable pensions and annuities...............................................................................................................................

9

00

00

10. Rents, royalties, partnerships, S corps, estates, trusts, etc.................................................................................

10

00

00

11.

Farm income or (loss).................................................................................................................................................

11

00

00

12. Unemployment compensation (insurance).............................................................................................................

12

00

00

13. Taxable Social Security Benefits................................................................................................................................

13

00

00

14. Other income (state nature and source)

14

00

00

15. Total income. Add Lines 1 through 14......................................................................................................................

15

00

00

16. Total Federal Adjustments (See instructions on Page 6)......................................................................................

16

00

00

17. Federal Adjusted Gross Income for Delaware purposes. Subtract Line 16 from 15.......................................

17

00

00

COLUMN 1

COLUMN 2

SECTION B - DELAWARE MODIFICATIONS AND ADJUSTMENTS - ADDITIONS ( + )

18. Interest received on obligations of any state other than Delaware......................................................................

18

00

00

19. Fiduciary adjustment, oil depletion...........................................................................................................................

19

00

00

20. TOTAL - Add Lines 18 & 19.........................................................................................................................................

20

00

00

21.

Add Lines 17 & 20.......................................................................................................................................................

21

00

00

COLUMN 1

COLUMN 2

SECTION C - DELAWARE MODIFICATIONS AND ADJUSTMENTS - SUBTRACTIONS ( - )

00

00

22

22. Interest received on U.S. Obligations.......................................................................................................................

23

23. Pension/Retirement Exclusions

00

00

(For a definition of eligible income, see instructions on Page 7)

24. Delaware State tax refund...........................................................................................................................................

24

00

00

25. Fiduciary Adjustment, Work Opportunity Credit, Delaware NOL Carryforward....................................................

25

00

00

26. Taxable Social Security Benefits/Railroad Retirement Benefits/Higher Education Exclusion.........................

26

00

00

27. TOTAL - Add Lines 22 through 26..............................................................................................................................

27

00

00

28. Subtract Line 27 from Line 21 and enter here........................................................................................................

28

00

00

29. Exclusion for certain persons 60 and over or disabled (See instructions on Page 8)....................................

29

00

00

30A.

Subtract Line 29 from Line 28. This is your modified Delaware Source Income.

Column 2.

30A

00

.

Enter on front side Line 42, Box A

........................................................................................................................................................

30B.

Subtract Line 29 from Line 28. This is your Delaware Adjusted Gross Income.

Column 1.

30B

Enter on front side Line 37 and Line 42, Box B.

......................................................................................

00

COLUMN 1

SECTION D - ITEMIZED DEDUCTIONS (ATTACH FEDERAL SCHEDULE A, FORM 1040)

31

31. Enter total Itemized Deductions

00

(If Filing Status 3, see instructions on Page 8)............................................

32

32. Enter Foreign Taxes Paid (See instructions on Page 8)............................................................................................

00

33. Enter Charitable Mileage Deduction (See instructions on Page 8).........................................................................

33

00

34

34. TOTAL - Add Lines 31, 32, and 33 ...............................................................................................................................

00

35a

35a. Enter State Income Tax included in Line 31 above (See Instructions on Page 8)................................................

00

35b. Enter Form 700 Tax Credit Adjustment (See instructions on Page 9).....................................................................

35b

00

36. Subtract Line 35a and 35b from Line 34. Enter here and on front, Line 38..........................................................

36

00

If you would like your refund deposited directly to your checking or savings account,

SECTION E - DIRECT DEPOSIT INFORMATION

complete boxes a, b, c, and d below. See instructions for details.

a. Routing Number

b. Type:

Checking

Savings

d. Is this refund going to or through an account that is

c. Account Number

located outside of the United States?

Yes

No

NOTE: If your refund is adjusted by $100.00 or more, a paper check will be issued and mailed to the address on your return.

NET BALANCE DUE (LINE 58):

NET REFUND (LINE 59):

ZERO (LINE 59):

DELAWARE DIVISION OF REVENUE

DELAWARE DIVISION OF REVENUE

DELAWARE DIVISION OF REVENUE

P.O. BOX 8752, WILMINGTON, DE 19899-8752

P.O. BOX 8772, WILMINGTON, DE 19899-8772

P.O. BOX 8711, WILMINGTON, DE 19899-8711

MAKE CHECK PAYABLE TO : DELAWARE DIVISION OF REVENUE. REMEMBER TO ATTACH APPROPRIATE SUPPORTING SCHEDULES

WHEN FILING YOUR RETURN AND KEEP A COPY OF THE RETURN FOR YOUR RECORDS

(Rev 10/31/13)

1

1 2

2 3

3