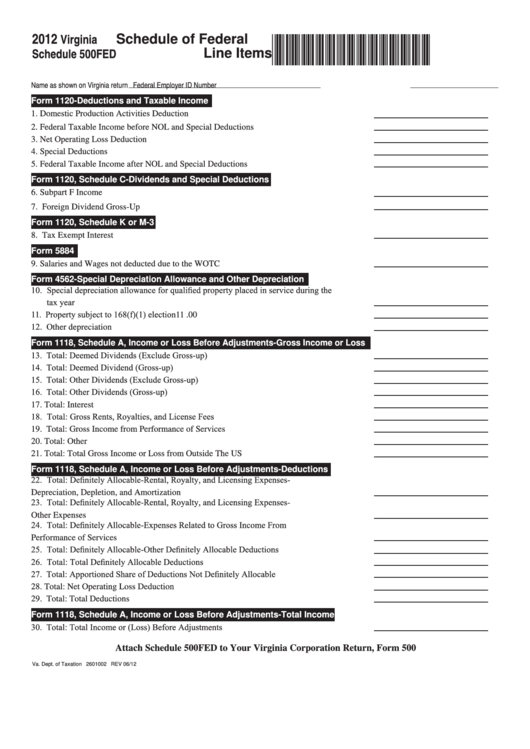

2012

Virginia

Schedule of Federal

*VASFED112000*

Schedule 500FED

Line Items

Name as shown on Virginia return

Federal Employer ID Number

Form 1120-Deductions and Taxable Income

1.

Domestic Production Activities Deduction ............................................................................... 1

.00

2.

Federal Taxable Income before NOL and Special Deductions .................................................. 2

.00

3.

Net Operating Loss Deduction ................................................................................................. 3

.00

4.

Special Deductions .................................................................................................................... 4

.00

5.

Federal Taxable Income after NOL and Special Deductions .................................................... 5

.00

Form 1120, Schedule C-Dividends and Special Deductions

6.

Subpart F Income ....................................................................................................................... 6

.00

7.

Foreign Dividend Gross-Up ...................................................................................................... 7

.00

Form 1120, Schedule K or M-3

8.

Tax Exempt Interest ................................................................................................................... 8

.00

Form 5884

9.

Salaries and Wages not deducted due to the WOTC ................................................................. 9

.00

Form 4562-Special Depreciation Allowance and Other Depreciation

10. Special depreciation allowance for qualified property placed in service during the

tax year ................................................................................................................................. 10

.00

11. Property subject to 168(f)(1) election ...................................................................................... 11

.00

12. Other depreciation .................................................................................................................. 12

.00

Form 1118, Schedule A, Income or Loss Before Adjustments-Gross Income or Loss

13. Total: Deemed Dividends (Exclude Gross-up) ........................................................................ 13

.00

14. Total: Deemed Dividend (Gross-up) ....................................................................................... 14

.00

15. Total: Other Dividends (Exclude Gross-up) ............................................................................ 15

.00

16. Total: Other Dividends (Gross-up) .......................................................................................... 16

.00

17. Total: Interest .......................................................................................................................... 17

.00

18. Total: Gross Rents, Royalties, and License Fees ..................................................................... 18

.00

19. Total: Gross Income from Performance of Services ................................................................ 19

.00

20. Total: Other ............................................................................................................................. 20

.00

21. Total: Total Gross Income or Loss from Outside The US ....................................................... 21

.00

Form 1118, Schedule A, Income or Loss Before Adjustments-Deductions

22. Total: Definitely Allocable-Rental, Royalty, and Licensing Expenses-

Depreciation, Depletion, and Amortization ............................................................................. 22

.00

23. Total: Definitely Allocable-Rental, Royalty, and Licensing Expenses-

Other Expenses ........................................................................................................................ 23

.00

24. Total: Definitely Allocable-Expenses Related to Gross Income From

Performance of Services .......................................................................................................... 24

.00

25. Total: Definitely Allocable-Other Definitely Allocable Deductions ........................................ 25

.00

26. Total: Total Definitely Allocable Deductions .......................................................................... 26

.00

27. Total: Apportioned Share of Deductions Not Definitely Allocable ........................................ 27

.00

28. Total: Net Operating Loss Deduction ...................................................................................... 28

.00

29. Total: Total Deductions ........................................................................................................... 29

.00

Form 1118, Schedule A, Income or Loss Before Adjustments-Total Income or Loss

30. Total: Total Income or (Loss) Before Adjustments .................................................................. 30

.00

Attach Schedule 500FED to Your Virginia Corporation Return, Form 500

Va. Dept. of Taxation 2601002 REV 06/12

1

1