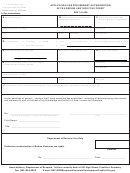

Form 41a720-S85 - Application For Preliminary Authorization Of The Endow Kentucky Tax Credit Page 2

ADVERTISEMENT

41A720-S85 (2-13)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

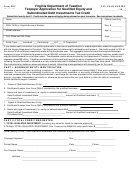

INSTRUCTIONS—APPLICATION FOR PRELIMINARY AUTHORIZATION

OF THE ENDOW KENTUCKY TAX CREDIT

A taxpayer that seeks preliminary authorization of an Endow Kentucky Tax credit as provided by KRS 141.438(7) for

an endowment gift to a permanent endowment held by an approved foundation (qualified community foundation,

county–specific component fund, or affiliate community foundation, which has been certified under KRS 147A.325)

shall file the Application with the Kentucky Department of Revenue.

The process for acceptance and consideration of the Application is set forth in 103 KAR 15:195E Sections 2 through

8, or 103 KAR 15:195 Sections 2 through 8. All questions shall be directed to:

KRC.WEBResponseEconomicDevelopmentCredits@ky.gov.

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2