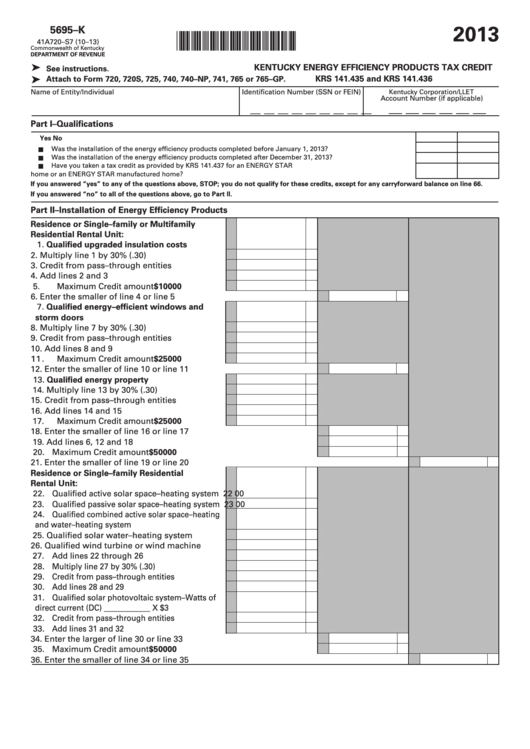

Form 5695-K - Kentucky Energy Efficiency Products Tax Credit - 2013

ADVERTISEMENT

2013

5695–K

*1300030306*

41A720–S7 (10–13)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

KENTUCKY ENERGY EFFICIENCY PRODUCTS TAX CREDIT

See instructions.

➤

KRS 141.435 and KRS 141.436

Attach to Form 720, 720S, 725, 740, 740–NP, 741, 765 or 765–GP.

➤

Name of Entity/Individual

Identification Number (SSN or FEIN)

Kentucky Corporation/LLET

Account Number (if applicable)

__ __ __ __ __ __

__ __ __ __ __ __ __ __ __

Part I–Qualifications

Yes

No

Was the installation of the energy efficiency products completed before January 1, 2013? ...........................................

<

Was the installation of the energy efficiency products completed after December 31, 2013? .........................................

<

Have you taken a tax credit as provided by KRS 141.437 for an ENERGY STAR

<

home or an ENERGY STAR manufactured home? ...............................................................................................................

If you answered “yes” to any of the questions above, STOP; you do not qualify for these credits, except for any carryforward balance on line 66.

If you answered “no” to all of the questions above, go to Part II.

Part II–Installation of Energy Efficiency Products

Residence or Single–family or Multifamily

Residential Rental Unit:

1. Qualified upgraded insulation costs ............

1

00

2.

Multiply line 1 by 30% (.30) ........................

2

00

3.

Credit from pass–through entities .............

3

00

4.

Add lines 2 and 3 .........................................

4

00

5.

Maximum Credit amount ............................

5

$100 00

6.

Enter the smaller of line 4 or line 5 .................................................... 6

00

7. Qualified energy–efficient windows and

storm doors ....................................................

7

00

8.

Multiply line 7 by 30% (.30) ........................

8

00

9.

Credit from pass–through entities .............

9

00

10.

Add lines 8 and 9 ......................................... 10

00

11.

Maximum Credit amount ............................ 11

$250 00

12.

Enter the smaller of line 10 or line 11 ................................................ 12

00

13. Qualified energy property ............................. 13

00

14.

Multiply line 13 by 30% (.30) ...................... 14

00

15.

Credit from pass–through entities ............. 15

00

16.

Add lines 14 and 15 ..................................... 16

00

17.

Maximum Credit amount ............................ 17

$250 00

18.

Enter the smaller of line 16 or line 17 ................................................ 18

00

19. Add lines 6, 12 and 18 ........................................................................... 19

00

20. Maximum Credit amount ....................................................................... 20

$500 00

21. Enter the smaller of line 19 or line 20 ........................................................................................

21

00

Residence or Single–family Residential

Rental Unit:

22. Qualified active solar space–heating system

22

00

23. Qualified passive solar space–heating system 23

00

24. Qualified combined active solar space–heating

and water–heating system ............................... 24

00

25. Qualified solar water–heating system ......... 25

00

26. Qualified wind turbine or wind machine ..... 26

00

27. Add lines 22 through 26 ................................. 27

00

28. Multiply line 27 by 30% (.30) ............................ 28

00

29. Credit from pass–through entities .................... 29

00

30. Add lines 28 and 29 ......................................... 30

00

31. Qualified solar photovoltaic system–Watts of

direct current (DC) ____________ X $3 ............ 31

00

32. Credit from pass–through entities .................... 32

00

33. Add lines 31 and 32 ......................................... 33

00

34. Enter the larger of line 30 or line 33 ..................................................... 34

00

35. Maximum Credit amount ....................................................................... 35

$500 00

36. Enter the smaller of line 34 or line 35 ......................................................................................... 36

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4