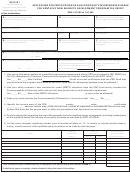

Form 8874(K) - Application For Certification Of Qualified Equity Investments Eligible For Kentucky New Markets Development Program Tax Credit Page 3

ADVERTISEMENT

41A720-S80 (8874(K)) (11-10)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

INSTRUCTIONS—APPLICATION FOR CERTIFICATION OF QUALIFIED EQUITY INVESTMENTS

ELIGIBLE FOR KENTUCKY NEW MARKETS DEVELOPMENT PROGRAM TAX CREDIT

A qualified community development entity (CDE) that seeks to have an equity investment or long-term debt security

certified as a qualified equity investment eligible for the tax credit provided by KRS 141.434 shall file this application,

Form 8874(K), with the Kentucky Department of Revenue (department). A nonrefundable $1,000 application fee shall

be attached to the application. Payment of the fee shall be by cashier’s check only.

The department will notify you within thirty (30) days after receipt of the application whether the application is

approved or denied. If the department intends to deny your application, you will be notified in writing (via certified

mail) by the department of the reason for denial. Upon receipt of the notice of denial, the CDE has fifteen (15) days

to provide the department with information necessary to correct any deficiencies in the application. Upon receipt

of any additional information, the department shall have an additional thirty (30) days to either approve or deny the

application.

If the CDE fails to provide the information or complete its application within the fifteen (15) day period, the application

shall be deemed denied and must be resubmitted in full with a new submission date.

If the department determines that the application is in compliance with the provisions of KRS 141.432 to 141.434,

a copy of the application will be returned to you (via certified mail) containing the department’s approval of the

qualified equity investments and taxpayers eligible for tax credits under KRS 141.434. “Department’s approval”

means the department’s certification as provided by KRS 141.433(3) of the proposed equity investments or long-term

debt securities as qualified equity investments eligible for tax credits provided by KRS 141.432 to 141.434. If the tax

credits are limited because of the $5 million tax credit cap each fiscal year, the department will notify the CDE of the

limitation and the CDE may elect to withdraw its application.

If the taxpayers eligible to claim the credits change due to a transfer of a qualified equity investment or a change in

an allocation pursuant to KRS 141.434(2), the CDE shall notify the department of such change.

Cash in the amount of the certified purchase price of the qualified equity investment must be received by the CDE

from each qualified equity investor within ninety (90) days after the receipt of the approved application by the CDE.

The CDE shall provide the department with evidence of the receipt of the cash in exchange for the qualified equity

investment within ten (10) business days after receipt of the cash. If the CDE does not receive cash from a taxpayer

and issue the qualified equity investment to the taxpayer within ninety (90) days following the receipt of the approved

application, the approved application shall become void for that taxpayer and the CDE must file a new application to

certify the taxpayer’s qualified equity investment in accordance with the application process outlined above.

The CDE shall complete Form 8874(K)-A, Notice of Kentucky New Markets Development Program Tax Credit and

Certification, and file a copy with the department for each taxpayer as evidence of the receipt of cash for the qualified

equity investment. If the department is satisfied that the cash amount of the qualified equity investment was received

by the CDE from the qualified equity investor, the department shall return Form 8874(K)-A containing the department’s

approval of the tax credit to both the CDE and taxpayer.

Page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3