is determined. The amount of tax paid in monthly and quarterly tax returns for years two (2) through ten (10) is then based upon estimated

credit calculated using the prior year’s actual new jobs number.

After the close of the taxable year for years two (2) through ten (10), annual returns are filed reconciling the estimated tax paid in the monthly

and quarterly filings through the year and the actual amount of annual tax due based upon the actual new jobs percentage for the year

determined at the end of the year.

The annual payroll, annual gross receipts and annual median compensation requirements applicable to any small business shall be

determined when qualified investment is first placed in service or use. The median compensation requirement is subject to inflation adjustment

during the ten (10) through thirteen (13) year credit period.

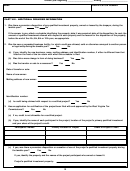

The following constraints apply for tax years 1987 thru 2001:

SMALL BUSINESS CREDIT CRITERIA

YEAR

ANNUAL

ANNUAL GROSS

MEDIAN ANUUAL

PAYROLL

RECEIPTS

COMPENSATION

1987 -88

$1,500,000

or

$5,000,000

$11,000

1989

1,562,050

or

5,206,850

11,450

1990*

1,700,000

and

5,500,000

12,000

1991

1,716,300

and

5,721,050

12,550

1992

1,806,950

and

6,023,200

13,250

1993

1,862,200

and

6,207,350

13,650

1994

1,919,100

and

6,397,150

14,050

1995

1,969,150

and

6,563,800

14,400

1996

2,025,150

and

6,750,600

14,850

1997

2,081,100

and

6,937,000

15,250

1998

2,137,800

and

7,126,050

15,650

1999

2,174,050

and

7,246,950

15,900

2000

2,212,000

and

7,373,450

16,200

2001

2,280,800

and

7,602,650

16,700

* Beginning with investments placed into service in 1990, the small business criteria must also apply to the taxpayer's controlled group.

Annual payroll

- The annual payroll of a business shall include the employees of the business whether employed on a full-time, part-

time, temporary, or other basis, during the preceding twelve (12) months. The payroll of the business shall be divided by the number of weeks,

including fractions of a week that it has been in business, and the result multiplied by fifty-two (52).

Annual gross receipts

- The annual gross receipts of a business which has been in business for three (3) or more complete fiscal

years means the highest annual gross revenues of the business from among the last three (3) fiscal years. For purposes of this definition,

the gross revenues of the business includes revenues from sales of tangible personal property and services, interest, rents, royalties, fees,

commissions and receipts from any other sources, but less returns and allowances, sales of fixed assets, interaffiliated transactions between

a business and its domestic and foreign affiliates, and taxes collected for remittance to a third party, as shown on its books for federal income

tax purposes.

Median annual compensation

- The median annual compensation shall be determined by arranging the annual compensation

amount of each employee in a hierarchy ranking from lowest to highest and then selecting that element from the range of so arranged amounts

(elements) which is the middle number, (i.e., that element which has an equal number of elements in the range of elements which rank

above and below it).

In the case of a range having an even number of elements, the median is the average of the two (2) middle numbers, i.e., one half

(1/2) of the sum of the highest ranked element of the lower half of the range and the lowest ranked element of the upper half of the range.

The compensation of an employee employed on a seasonal or temporary basis shall not be counted in the determination of the median

salary.

For purposes of determining median compensation for part-time employees, the salaries of such employees shall be annualized.

The salary of a part-time employee is annualized by multiplying the hourly compensation of the part-time employee by the number of hours

in the normal work year for full-time employees of the business.

The annualized compensation for each part-time employee is treated as an element in the range of numbers used to determine median

annual compensation of the business.

5

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28