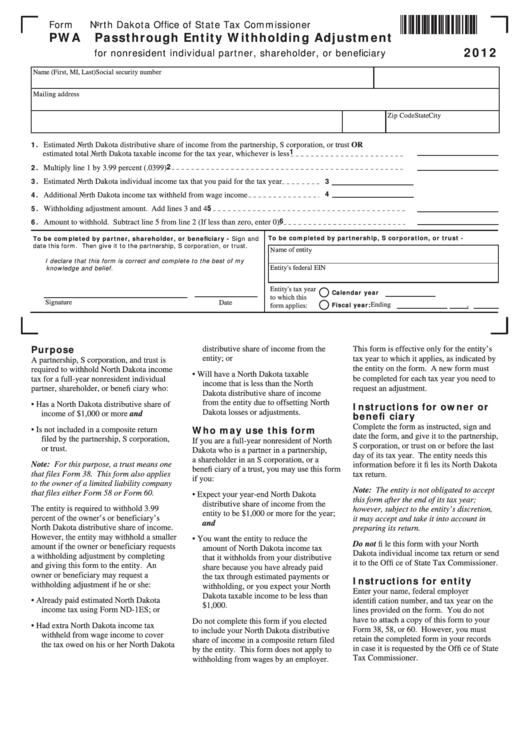

Form

North Dakota Office of State Tax Commissioner

PWA

Passthrough Entity Withholding Adjustment

2012

for nonresident individual partner, shareholder, or beneficiary

Name (First, MI, Last)

Social security number

Mailing address

City

State

Zip Code

1.

Estimated North Dakota distributive share of income from the partnership, S corporation, or trust OR

1

estimated total North Dakota taxable income for the tax year, whichever is less

2

2.

Multiply line 1 by 3.99 percent (.0399)

3.

3

Estimated North Dakota individual income tax that you paid for the tax year

4

4.

Additional North Dakota income tax withheld from wage income

5

5.

Withholding adjustment amount. Add lines 3 and 4

6

6.

Amount to withhold. Subtract line 5 from line 2 (If less than zero, enter 0)

To be completed by partnership, S corporation, or trust -

To be completed by partner, shareholder, or beneficiary - Sign and

date this form. Then give it to the partnership, S corporation, or trust.

Name of entity

I declare that this form is correct and complete to the best of my

knowledge and belief.

Entity's federal EIN

Entity's tax year

Calendar year

to which this

Signature

Date

Fiscal year:

Ending

,

form applies:

Purpose

distributive share of income from the

This form is effective only for the entity’s

entity; or

tax year to which it applies, as indicated by

A partnership, S corporation, and trust is

the entity on the form. A new form must

required to withhold North Dakota income

• Will have a North Dakota taxable

be completed for each tax year you need to

tax for a full-year nonresident individual

income that is less than the North

request an adjustment.

partner, shareholder, or benefi ciary who:

Dakota distributive share of income

from the entity due to offsetting North

Instructions for owner or

• Has a North Dakota distributive share of

Dakota losses or adjustments.

benefi ciary

income of $1,000 or more and

Complete the form as instructed, sign and

Who may use this form

• Is not included in a composite return

date the form, and give it to the partnership,

filed by the partnership, S corporation,

If you are a full-year nonresident of North

S corporation, or trust on or before the last

or trust.

Dakota who is a partner in a partnership,

day of its tax year. The entity needs this

a shareholder in an S corporation, or a

Note: For this purpose, a trust means one

information before it fi les its North Dakota

benefi ciary of a trust, you may use this form

that files Form 38. This form also applies

tax return.

if you:

to the owner of a limited liability company

Note: The entity is not obligated to accept

that files either Form 58 or Form 60.

• Expect your year-end North Dakota

this form after the end of its tax year;

distributive share of income from the

The entity is required to withhold 3.99

however, subject to the entity’s discretion,

entity to be $1,000 or more for the year;

percent of the owner’s or beneficiary’s

it may accept and take it into account in

and

North Dakota distributive share of income.

preparing its return.

However, the entity may withhold a smaller

• You want the entity to reduce the

Do not fi le this form with your North

amount if the owner or beneficiary requests

amount of North Dakota income tax

Dakota individual income tax return or send

a withholding adjustment by completing

that it withholds from your distributive

it to the Offi ce of State Tax Commissioner.

and giving this form to the entity. An

share because you have already paid

owner or beneficiary may request a

the tax through estimated payments or

Instructions for entity

withholding adjustment if he or she:

withholding, or you expect your North

Enter your name, federal employer

Dakota taxable income to be less than

• Already paid estimated North Dakota

identifi cation number, and tax year on the

$1,000.

income tax using Form ND-1ES; or

lines provided on the form. You do not

have to attach a copy of this form to your

Do not complete this form if you elected

• Had extra North Dakota income tax

Form 38, 58, or 60. However, you must

to include your North Dakota distributive

withheld from wage income to cover

retain the completed form in your records

share of income in a composite return filed

the tax owed on his or her North Dakota

in case it is requested by the Offi ce of State

by the entity. This form does not apply to

Tax Commissioner.

withholding from wages by an employer.

1

1