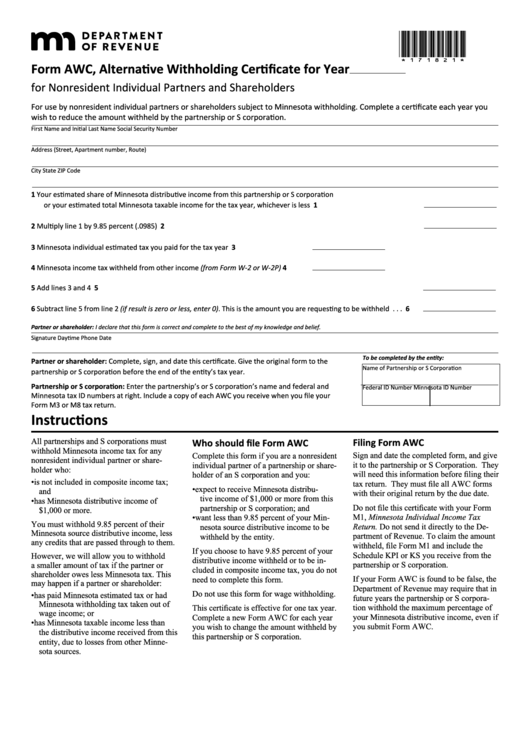

*171821*

Form AWC, Alternative Withholding Certificate for Year

for Nonresident Individual Partners and Shareholders

For use by nonresident individual partners or shareholders subject to Minnesota withholding. Complete a certificate each year you

wish to reduce the amount withheld by the partnership or S corporation.

First Name and Initial

Last Name

Social Security Number

Address (Street, Apartment number, Route)

City

State

ZIP Code

1 Your estimated share of Minnesota distributive income from this partnership or S corporation

or your estimated total Minnesota taxable income for the tax year, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Multiply line 1 by 9.85 percent (.0985) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Minnesota individual estimated tax you paid for the tax year . . . . . . . . . . . . . . . . . 3

4 Minnesota income tax withheld from other income (from Form W-2 or W-2P) . . . . 4

5 Add lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Subtract line 5 from line 2 (if result is zero or less, enter 0). This is the amount you are requesting to be withheld . . . 6

Partner or shareholder: I declare that this form is correct and complete to the best of my knowledge and belief.

Signature

Daytime Phone

Date

To be completed by the entity:

Partner or shareholder: Complete, sign, and date this certificate. Give the original form to the

Name of Partnership or S Corporation

partnership or S corporation before the end of the entity’s tax year.

Partnership or S corporation: Enter the partnership’s or S corporation’s name and federal and

Federal ID Number

Minnesota ID Number

Minnesota tax ID numbers at right. Include a copy of each AWC you receive when you file your

Form M3 or M8 tax return.

Instructions

All partnerships and S corporations must

Filing Form AWC

Who should file Form AWC

withhold Minnesota income tax for any

Sign and date the completed form, and give

Complete this form if you are a nonresident

nonresident individual partner or share-

it to the partnership or S Corporation. They

individual partner of a partnership or share-

holder who:

will need this information before filing their

holder of an S corporation and you:

• is not included in composite income tax;

tax return. They must file all AWC forms

• expect to receive Minnesota distribu-

and

with their original return by the due date.

tive income of $1,000 or more from this

• has Minnesota distributive income of

Do not file this certificate with your Form

partnership or S corporation; and

$1,000 or more.

M1, Minnesota Individual Income Tax

• want less than 9.85 percent of your Min-

You must withhold 9.85 percent of their

Return. Do not send it directly to the De-

nesota source distributive income to be

Minnesota source distributive income, less

partment of Revenue. To claim the amount

withheld by the entity.

any credits that are passed through to them.

withheld, file Form M1 and include the

If you choose to have 9.85 percent of your

Schedule KPI or KS you receive from the

However, we will allow you to withhold

distributive income withheld or to be in-

partnership or S corporation.

a smaller amount of tax if the partner or

cluded in composite income tax, you do not

shareholder owes less Minnesota tax. This

If your Form AWC is found to be false, the

need to complete this form.

may happen if a partner or shareholder:

Department of Revenue may require that in

Do not use this form for wage withholding.

• has paid Minnesota estimated tax or had

future years the partnership or S corpora-

Minnesota withholding tax taken out of

tion withhold the maximum percentage of

This certificate is effective for one tax year.

wage income; or

your Minnesota distributive income, even if

Complete a new Form AWC for each year

• has Minnesota taxable income less than

you submit Form AWC.

you wish to change the amount withheld by

the distributive income received from this

this partnership or S corporation.

entity, due to losses from other Minne-

sota sources.

1

1