7

Form 8947 (Rev. 10-2013)

Page

Section references are to the Internal Revenue Code unless otherwise

If you check the “Yes” box, you are authorizing the IRS to call the

noted.

designee to answer any questions that may arise and the designee to

call the IRS with any questions related to the administration of the 2014

Future Developments

branded prescription drug fee year. You are also authorizing the

designee to:

For the latest information about developments related to Form 8947 and

its instructions, such as legislation enacted after they were published,

• Receive copies of IRS letters upon request,

go to

• Respond to IRS letters, and

What's New

• Receive and provide information regarding the status of a payment

or an amount due back to you.

For the 2012 sales year, you can file Form 8947 as a fillable PDF

For more information, see Definitions and Item B. Covered Entity

document.

Information below. Also, see Temporary Regulations sections 51.1T

General Instructions

through 51.12T, and section 51.6302-1T.

Who Files

Purpose of Form

Generally, each manufacturer or importer of branded prescription drugs

Use Form 8947 to report the following information for branded

with sales to specified government programs (or sales due to coverage

prescription drugs sold by covered entities to specified government

under the programs) may submit Form 8947. Each entity that is treated

programs (or sales due to coverage under the programs) during sales

as a single covered entity is requested to file one Form 8947, providing

year 2012.

all requested information for each such manufacturing and reporting

• National Drug Codes (NDCs).

entity, as described in these instructions.

• Medicaid state supplemental rebate information.

Schedules A, B, C, D, and E. All filers must complete page 1 and page

6, which includes Schedule E, Summary of Form 8947, and Part II,

• Section 45C orphan drug information.

Signature of Official Signing On Behalf of the Covered Entity (Single-

• Designated entity and controlled group members information, if

Member, Common Parent of an Affiliated Group, or Other Designated

applicable.

Entity) and Consent by the Common Parent or Designated Entity (if

The IRS will use the information you submit on Form 8947 to calculate

applicable).

the annual fee for branded prescription drug sales ("the fee"). The fee is

First time filers must also attach Schedule A, Branded Prescription

imposed by section 9008 of Public Law 111-148 (Patient Protection and

Drug Information—First Time Filers Only.

Affordable Care Act), as amended by Public Law 111-152 (Health Care

Subsequent year filers with changes to report must attach Schedule

and Education Reconciliation Act of 2010) (the “Act”).

B, Branded Prescription Drug Information NDC Additions and Deletions,

If you want to designate your employee to discuss your report with

or Schedule C, Branded Prescription Drug Information Orphan Drug

the IRS, check the "Yes" box on page 6, under Alternate Contact Person

Changes—Previously Reported NDCs, or both.

Designee. Also, enter the designee's name, title, and phone number.

Completing Pages 1 and 6, and the Correct Schedule(s)

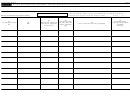

First time filer

Subsequent year filer with

Subsequent year filer with no

Subsequent year filer with no

(check Item A, box 1)

changes

changes, reporting rebates

changes, not reporting rebates

(check Item A, box 2)

(check Item A, box 3)

(check Item A, box 4)

Page 1

Yes

Yes

Yes

Yes

Schedule A

Yes

No

No

No

Yes, if NDC additions or

Schedule B

No

deletions (1), (2), (3)

No

No

Schedule C

No

Yes, if orphan drug changes (1), (3)

No

No

Schedule D

No

Yes, if reporting rebates (1), (3)

Yes

No

Schedule E

Yes, if Item B, box 2a or 2b,

Yes, if Item B, box 2a or 2b,

Yes, if Item B, box 2a or 2b,

Yes, if Item B, box 2a or 2b,

Schedule E, Line 1

checked

checked

checked

checked

Schedule E, Line 2

Yes

No

No

No

Schedule E, Line 3

Yes

No

No

No

Schedule E, Line 4

No

Yes, if Schedule B attached

No

No

Schedule E, Line 5

No

Yes, if Schedule B attached

No

No

Schedule E, Line 6

No

Yes, if Schedule B attached

No

No

Schedule E, Line 7

No

Yes, if Schedule C attached

No

No

Schedule E, Line 8

No

Yes, if Schedule D attached

Yes

No

Schedule E, Line 9

No

Yes, if Schedule D attached

Yes

No

Part II

Yes

Yes

Yes

Yes

(1) NDCs reported on Schedule B cannot be shown on Schedules C or D.

(2) On Schedule B, Section I, report as additions only NDCs that were not associated with the covered entity for the previous sales year.

(3) On Schedule B, Section II: Schedule C; or Schedule D, report only NDCs that were associated with the covered entity for the previous sales year.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9