Form Wv/mft-510 A - Motor Fuel Excise Tax Cash Board

ADVERTISEMENT

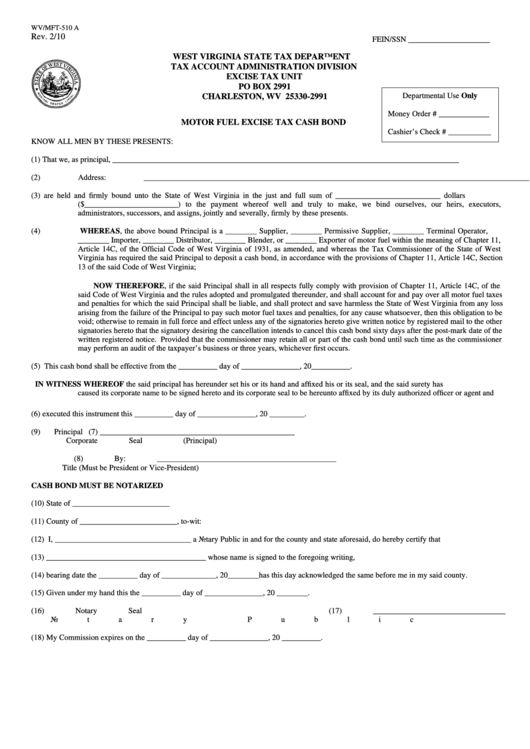

WV/MFT-510 A

Rev. 2/10

FEIN/SSN _____________________

WEST VIRGINIA STATE TAX DEPARTMENT

TAX ACCOUNT ADMINISTRATION DIVISION

EXCISE TAX UNIT

PO BOX 2991

Departmental Use Only

CHARLESTON, WV 25330-2991

Money Order # _____________

MOTOR FUEL EXCISE TAX CASH BOND

Cashier’s Check # ___________

KNOW ALL MEN BY THESE PRESENTS:

(1)

That we, as principal, _________________________________________________________________________________________

(2)

Address: ___________________________________________________________________________________________________

(3)

are held and firmly bound unto the State of West Virginia in the just and full sum of ___________________________ dollars

($________________________) to the payment whereof well and truly to make, we bind ourselves, our heirs, executors,

administrators, successors, and assigns, jointly and severally, firmly by these presents.

(4)

WHEREAS, the above bound Principal is a ________ Supplier, ________ Permissive Supplier, ________ Terminal Operator,

________ Importer, ________ Distributor, ________ Blender, or ________ Exporter of motor fuel within the meaning of Chapter 11,

Article 14C, of the Official Code of West Virginia of 1931, as amended, and whereas the Tax Commissioner of the State of West

Virginia has required the said Principal to deposit a cash bond, in accordance with the provisions of Chapter 11, Article 14C, Section

13 of the said Code of West Virginia;

NOW THEREFORE, if the said Principal shall in all respects fully comply with provision of Chapter 11, Article 14C, of the

said Code of West Virginia and the rules adopted and promulgated thereunder, and shall account for and pay over all motor fuel taxes

and penalties for which the said Principal shall be liable, and shall protect and save harmless the State of West Virginia from any loss

arising from the failure of the Principal to pay such motor fuel taxes and penalties, for any cause whatsoever, then this obligation to be

void; otherwise to remain in full force and effect unless any of the signatories hereto give written notice by registered mail to the other

signatories hereto that the signatory desiring the cancellation intends to cancel this cash bond sixty days after the post-mark date of the

written registered notice. Provided that the commissioner may retain all or part of the cash bond until such time as the commissioner

may perform an audit of the taxpayer’s business or three years, whichever first occurs.

(5)

This cash bond shall be effective from the __________ day of _______________, 20__________.

IN WITNESS WHEREOF the said principal has hereunder set his or its hand and affixed his or its seal, and the said surety has

caused its corporate name to be signed hereto and its corporate seal to be hereunto affixed by its duly authorized officer or agent and

(6)

executed this instrument this __________ day of _______________, 20 _________.

(9)

Principal

(7) __________________________________________________

Corporate Seal

(Principal)

(8) By: ______________________________________________

Title (Must be President or Vice-President)

CASH BOND MUST BE NOTARIZED

(10)

State of _________________________

(11)

County of _________________________, to-wit:

(12)

I, ___________________________________ a Notary Public in and for the county and state aforesaid, do hereby certify that

(13)

_________________________________________ whose name is signed to the foregoing writing,

(14)

bearing date the __________ day of ______________, 20________has this day acknowledged the same before me in my said county.

(15)

Given under my hand this the __________ day of _______________, 20 ________.

(16)

Notary Seal

(17) __________________________________

Notary Public

(18)

My Commission expires on the __________ day of _______________, 20 __________.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2