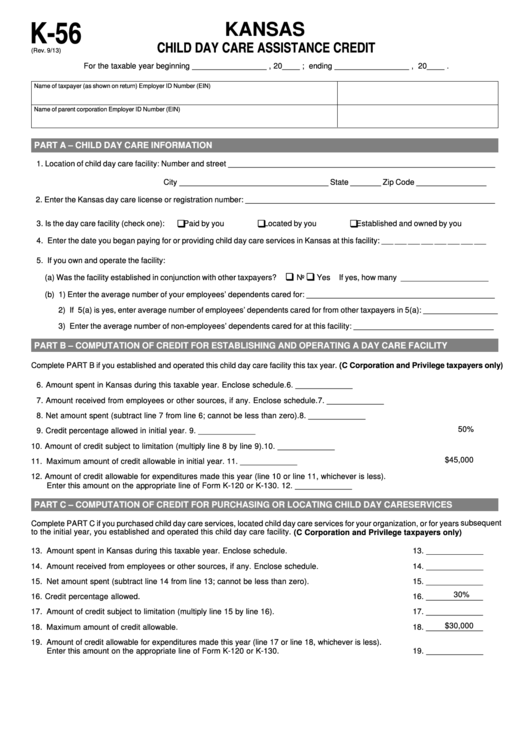

K-56

KANSAS

CHILD DAY CARE ASSISTANCE CREDIT

(Rev. 9/13)

For the taxable year beginning _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Employer ID Number (EIN)

Name of parent corporation

Employer ID Number (EIN)

PART A – CHILD DAY CARE INFORMATION

1. Location of child day care facility: Number and street _____________________________________________________________

City __________________________________ State _______ Zip Code ________________

2. Enter the Kansas day care license or registration number: _________________________________________________________

‰

‰

‰

3. Is the day care facility (check one):

Paid by you

Located by you

Established and owned by you

4. Enter the date you began paying for or providing child day care services in Kansas at this facility:

___ ___ ___ ___ ___ ___ ___ ___

5. If you own and operate the facility:

‰

‰

(a) Was the facility established in conjunction with other taxpayers?

No

Yes If yes, how many ____________________

(b) 1) Enter the average number of your employees’ dependents cared for: ___________________________________________

2) If 5(a) is yes, enter average number of employees’ dependents cared for from other taxpayers in 5(a): _________________

3) Enter the average number of non-employees’ dependents cared for at this facility: ________________________________

PART B – COMPUTATION OF CREDIT FOR ESTABLISHING AND OPERATING A DAY CARE FACILITY

Complete PART B if you established and operated this child day care facility this tax year. (C Corporation and Privilege taxpayers only)

6. Amount spent in Kansas during this taxable year. Enclose schedule.

6.

_____________

7. Amount received from employees or other sources, if any. Enclose schedule.

7.

_____________

8. Net amount spent (subtract line 7 from line 6; cannot be less than zero).

8.

_____________

50%

9. Credit percentage allowed in initial year.

9.

_____________

10. Amount of credit subject to limitation (multiply line 8 by line 9).

10.

_____________

$45,000

11. Maximum amount of credit allowable in initial year.

11.

_____________

12. Amount of credit allowable for expenditures made this year (line 10 or line 11, whichever is less).

Enter this amount on the appropriate line of Form K-120 or K-130.

12.

_____________

PART C – COMPUTATION OF CREDIT FOR PURCHASING OR LOCATING CHILD DAY CARESERVICES

Complete PART C if you purchased child day care services, located child day care services for your organization, or for years subsequent

to the initial year, you established and operated this child day care facility. (C Corporation and Privilege taxpayers only)

13. Amount spent in Kansas during this taxable year. Enclose schedule.

13.

_____________

14. Amount received from employees or other sources, if any. Enclose schedule.

14.

_____________

15. Net amount spent (subtract line 14 from line 13; cannot be less than zero).

15.

_____________

30%

16. Credit percentage allowed.

16.

_____________

17. Amount of credit subject to limitation (multiply line 15 by line 16).

17.

_____________

$30,000

18. Maximum amount of credit allowable.

18.

_____________

19. Amount of credit allowable for expenditures made this year (line 17 or line 18, whichever is less).

Enter this amount on the appropriate line of Form K-120 or K-130.

19.

_____________

1

1 2

2