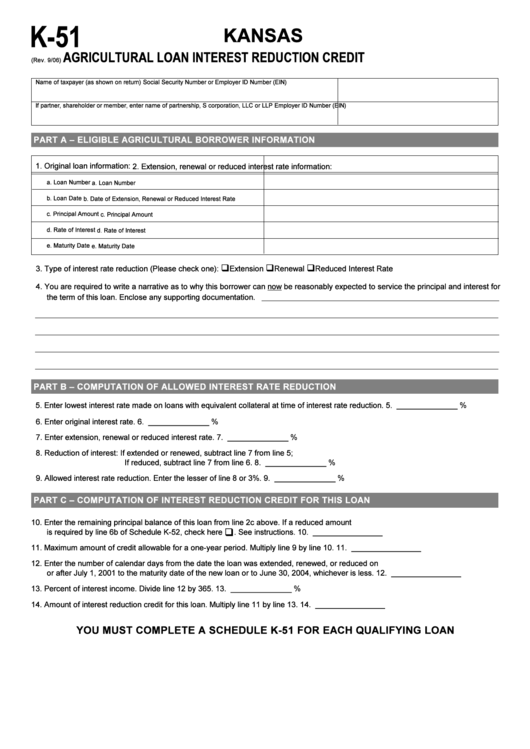

K-51

KANSAS

AGRICULTURAL LOAN INTEREST REDUCTION CREDIT

(Rev. 9/06)

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

PART A – ELIGIBLE AGRICULTURAL BORROWER INFORMATION

1. Original loan information:

2.

Extension, renewal or reduced interest rate information:

a. Loan Number

a. Loan Number

b. Loan Date

b. Date of Extension, Renewal or Reduced Interest Rate

c. Principal Amount

c. Principal Amount

d. Rate of Interest

d. Rate of Interest

e. Maturity Date

e. Maturity Date

q

q

q

3. Type of interest rate reduction (Please check one):

Extension

Renewal

Reduced Interest Rate

4. You are required to write a narrative as to why this borrower can now be reasonably expected to service the principal and interest for

the term of this loan. Enclose any supporting documentation.

PART B – COMPUTATION OF ALLOWED INTEREST RATE REDUCTION

5. Enter lowest interest rate made on loans with equivalent collateral at time of interest rate reduction.

5. ______________ %

6. Enter original interest rate.

6. ______________ %

7. Enter extension, renewal or reduced interest rate.

7. ______________ %

8. Reduction of interest: If extended or renewed, subtract line 7 from line 5;

If reduced, subtract line 7 from line 6.

8. ______________ %

9. Allowed interest rate reduction. Enter the lesser of line 8 or 3%.

9. ______________ %

PART C – COMPUTATION OF INTEREST REDUCTION CREDIT FOR THIS LOAN

10. Enter the remaining principal balance of this loan from line 2c above. If a reduced amount

q

is required by line 6b of Schedule K-52, check here

. See instructions.

10. ________________

11. Maximum amount of credit allowable for a one-year period. Multiply line 9 by line 10.

11. ________________

12. Enter the number of calendar days from the date the loan was extended, renewed, or reduced on

or after July 1, 2001 to the maturity date of the new loan or to June 30, 2004, whichever is less.

12. ________________

13. Percent of interest income. Divide line 12 by 365.

13. ______________ %

14. Amount of interest reduction credit for this loan. Multiply line 11 by line 13.

14. ________________

YOU MUST COMPLETE A SCHEDULE K-51 FOR EACH QUALIFYING LOAN

1

1 2

2