Appraisal Written Election Form

ADVERTISEMENT

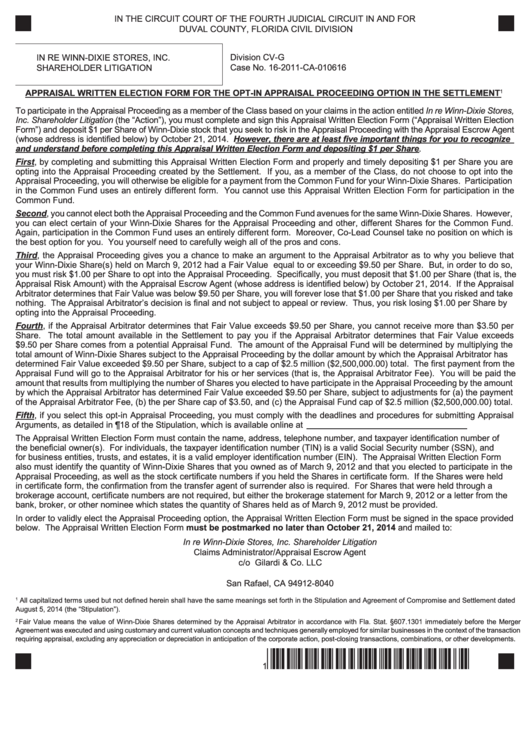

IN THE CIRCUIT COURT OF THE FOURTH JUDICIAL CIRCUIT IN AND FOR

DUVAL COUNTY, FLORIDA CIVIL DIVISION

Division CV-G

IN RE WINN-DIXIE STORES, INC.

SHAREHOLDER LITIGATION

Case No. 16-2011-CA-010616

APPRAISAL WRITTEN ELECTION FORM FOR THE OPT-IN APPRAISAL PROCEEDING OPTION IN THE SETTLEMENT

1

To participate in the Appraisal Proceeding as a member of the Class based on your claims in the action entitled In re Winn-Dixie Stores,

Inc. Shareholder Litigation (the “Action”), you must complete and sign this Appraisal Written Election Form (“Appraisal Written Election

Form”) and deposit $1 per Share of Winn-Dixie stock that you seek to risk in the Appraisal Proceeding with the Appraisal Escrow Agent

(whose address is identified below) by October 21, 2014. However, there are at least five important things for you to recognize

and understand before completing this Appraisal Written Election Form and depositing $1 per Share.

First, by completing and submitting this Appraisal Written Election Form and properly and timely depositing $1 per Share you are

opting into the Appraisal Proceeding created by the Settlement. If you, as a member of the Class, do not choose to opt into the

Appraisal Proceeding, you will otherwise be eligible for a payment from the Common Fund for your Winn-Dixie Shares. Participation

in the Common Fund uses an entirely different form. You cannot use this Appraisal Written Election Form for participation in the

Common Fund.

Second, you cannot elect both the Appraisal Proceeding and the Common Fund avenues for the same Winn-Dixie Shares. However,

you can elect certain of your Winn-Dixie Shares for the Appraisal Proceeding and other, different Shares for the Common Fund.

Again, participation in the Common Fund uses an entirely different form. Moreover, Co-Lead Counsel take no position on which is

the best option for you. You yourself need to carefully weigh all of the pros and cons.

Third, the Appraisal Proceeding gives you a chance to make an argument to the Appraisal Arbitrator as to why you believe that

your Winn-Dixie Share(s) held on March 9, 2012 had a Fair Value equal to or exceeding $9.50 per Share. But, in order to do so,

you must risk $1.00 per Share to opt into the Appraisal Proceeding. Specifically, you must deposit that $1.00 per Share (that is, the

Appraisal Risk Amount) with the Appraisal Escrow Agent (whose address is identified below) by October 21, 2014. If the Appraisal

Arbitrator determines that Fair Value was below $9.50 per Share, you will forever lose that $1.00 per Share that you risked and take

nothing. The Appraisal Arbitrator’s decision is final and not subject to appeal or review. Thus, you risk losing $1.00 per Share by

opting into the Appraisal Proceeding.

Fourth, if the Appraisal Arbitrator determines that Fair Value exceeds $9.50 per Share, you cannot receive more than $3.50 per

Share. The total amount available in the Settlement to pay you if the Appraisal Arbitrator determines that Fair Value exceeds

$9.50 per Share comes from a potential Appraisal Fund. The amount of the Appraisal Fund will be determined by multiplying the

total amount of Winn-Dixie Shares subject to the Appraisal Proceeding by the dollar amount by which the Appraisal Arbitrator has

determined Fair Value exceeded $9.50 per Share, subject to a cap of $2.5 million ($2,500,000.00) total. The first payment from the

Appraisal Fund will go to the Appraisal Arbitrator for his or her services (that is, the Appraisal Arbitrator Fee). You will be paid the

amount that results from multiplying the number of Shares you elected to have participate in the Appraisal Proceeding by the amount

by which the Appraisal Arbitrator has determined Fair Value exceeded $9.50 per Share, subject to adjustments for (a) the payment

of the Appraisal Arbitrator Fee, (b) the per Share cap of $3.50, and (c) the Appraisal Fund cap of $2.5 million ($2,500,000.00) total.

Fifth, if you select this opt-in Appraisal Proceeding, you must comply with the deadlines and procedures for submitting Appraisal

Arguments, as detailed in ¶18 of the Stipulation, which is available online at

The Appraisal Written Election Form must contain the name, address, telephone number, and taxpayer identification number of

the beneficial owner(s). For individuals, the taxpayer identification number (TIN) is a valid Social Security number (SSN), and

for business entities, trusts, and estates, it is a valid employer identification number (EIN). The Appraisal Written Election Form

also must identify the quantity of Winn-Dixie Shares that you owned as of March 9, 2012 and that you elected to participate in the

Appraisal Proceeding, as well as the stock certificate numbers if you held the Shares in certificate form. If the Shares were held

in certificate form, the confirmation from the transfer agent of surrender also is required. For Shares that were held through a

brokerage account, certificate numbers are not required, but either the brokerage statement for March 9, 2012 or a letter from the

bank, broker, or other nominee which states the quantity of Shares held as of March 9, 2012 must be provided.

In order to validly elect the Appraisal Proceeding option, the Appraisal Written Election Form must be signed in the space provided

below. The Appraisal Written Election Form must be postmarked no later than October 21, 2014 and mailed to:

In re Winn-Dixie Stores, Inc. Shareholder Litigation

Claims Administrator/Appraisal Escrow Agent

c/o Gilardi & Co. LLC

P.O. Box 8040

San Rafael, CA 94912-8040

All capitalized terms used but not defined herein shall have the same meanings set forth in the Stipulation and Agreement of Compromise and Settlement dated

1

August 5, 2014 (the “Stipulation”).

Fair Value means the value of Winn-Dixie Shares determined by the Appraisal Arbitrator in accordance with Fla. Stat. §607.1301 immediately before the Merger

2

Agreement was executed and using customary and current valuation concepts and techniques generally employed for similar businesses in the context of the transaction

requiring appraisal, excluding any appreciation or depreciation in anticipation of the corporate action, post-closing transactions, combinations, or other developments.

*WINNDXEFIRST*

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4