Form 315 - Ama Tax Credit - 2011

ADVERTISEMENT

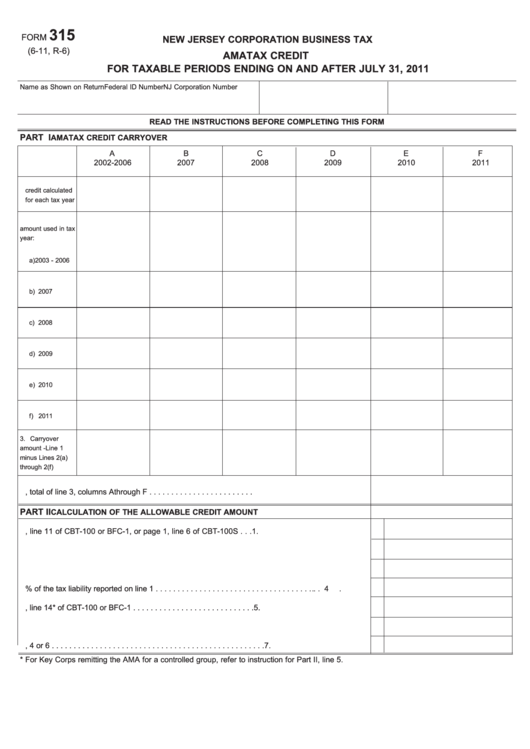

315

FORM

NEW JERSEY CORPORATION BUSINESS TAX

(6-11, R-6)

AMA TAX CREDIT

FOR TAXABLE PERIODS ENDING ON AND AFTER JULY 31, 2011

Name as Shown on Return

Federal ID Number

NJ Corporation Number

READ THE INSTRUCTIONS BEFORE COMPLETING THIS FORM

PART I

AMA TAX CREDIT CARRYOVER

A

B

C

D

E

F

2002-2006

2007

2008

2009

2010

2011

1. Enter the tax

credit calculated

for each tax year

2. Enter the

amount used in tax

year:

a) 2003 - 2006

b) 2007

c) 2008

d) 2009

e) 2010

f) 2011

3. Carryover

amount -Line 1

minus Lines 2(a)

through 2(f)

4. Total AMA tax credit carryover, total of line 3, columns A through F . . . . . . . . . . . . . . . . . . . . . . . .

PART II

CALCULATION OF THE ALLOWABLE CREDIT AMOUNT

1. Enter tax liability from page 1, line 11 of CBT-100 or BFC-1, or page 1, line 6 of CBT-100S . . .

1.

2. Enter the required minimum tax liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4. Enter 50% of the tax liability reported on line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. AMA tax liability from page 1, line 14* of CBT-100 or BFC-1 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Subtract line 5 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

7. Enter the lesser of lines 3, 4 or 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

* For Key Corps remitting the AMA for a controlled group, refer to instruction for Part II, line 5.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2