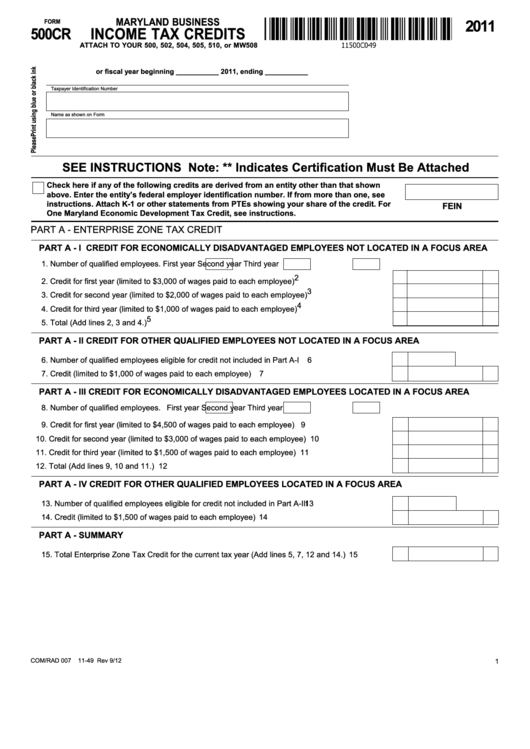

MARYLAND BUSINESS

2011

FORM

500CR

INCOME TAX CREDITS

ATTACH TO YOUR 500, 502, 504, 505, 510, or MW508

or fiscal year beginning ___________ 2011, ending ___________

Taxpayer Identification Number

Name as shown on Form

SEE INSTRUCTIONS Note: ** Indicates Certification Must Be Attached

Check here if any of the following credits are derived from an entity other than that shown

above. Enter the entity’s federal employer identification number. If from more than one, see

instructions. Attach K-1 or other statements from PTEs showing your share of the credit. For

FEIN

One Maryland Economic Development Tax Credit, see instructions.

PART A - ENTERPRISE ZONE TAX CREDIT

PART A - I

CREDIT FOR ECONOMICALLY DISADVANTAGED EMPLOYEES NOT LOCATED IN A FOCUS AREA

1. Number of qualified employees. First year

Second year

Third year

2. Credit for first year (limited to $3,000 of wages paid to each employee) ........................................... 2

3. Credit for second year (limited to $2,000 of wages paid to each employee) ..................................... 3

4. Credit for third year (limited to $1,000 of wages paid to each employee) .......................................... 4

5. Total (Add lines 2, 3 and 4.) ............................................................................................................... 5

PART A - II

CREDIT FOR OTHER QUALIFIED EMPLOYEES NOT LOCATED IN A FOCUS AREA

6. Number of qualified employees eligible for credit not included in Part A-I ........................................

6

7. Credit (limited to $1,000 of wages paid to each employee) ..............................................................

7

PART A - III CREDIT FOR ECONOMICALLY DISADVANTAGED EMPLOYEES LOCATED IN A FOCUS AREA

8. Number of qualified employees. First year

Second year

Third year

9. Credit for first year (limited to $4,500 of wages paid to each employee) .......................................... 9

10. Credit for second year (limited to $3,000 of wages paid to each employee) .................................... 10

11. Credit for third year (limited to $1,500 of wages paid to each employee) ......................................... 11

12. Total (Add lines 9, 10 and 11.) .......................................................................................................... 12

PART A - IV CREDIT FOR OTHER QUALIFIED EMPLOYEES LOCATED IN A FOCUS AREA

13. Number of qualified employees eligible for credit not included in Part A-III....................................... 13

14. Credit (limited to $1,500 of wages paid to each employee) ............................................................... 14

PART A - SUMMARY

15. Total Enterprise Zone Tax Credit for the current tax year (Add lines 5, 7, 12 and 14.) ..................... 15

COM/RAD 007

11-49

Rev 9/12

1

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19