2014 Schedule M15 Instructions

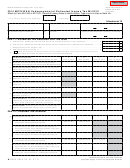

Underpayment of Estimated Income Tax for Individuals (Form M1)

Who Must File

Note: If any payment was made before the

• 90 percent of your current year’s original

installment due date, it is best to use the

tax liability (66.7 percent if you are a

If you are an individual, use this schedule to

regular method. Using the short method

farmer or commercial fi sherman); or

determine if you owe a penalty for under-

will cause you to pay a larger penalty than

paying estimated tax.

• 100 percent of your prior year’s total tax li-

the regular method. If the payment was only

ability—unless your federal adjusted gross

You may owe an underpayment penalty if

a few days early, the diff erence is likely to be

income on the 2013 Form M1 is more

you received income in 2014 on which $500

small.

than $150,000, you must use 110 percent

or more of Minnesota income tax is due

of your previous year’s tax liability instead

Continue with line 7 to use the optional

aft er you subtract:

of 100 percent.

short method.

• the Minnesota income tax that was with-

Nonresidents and part-year residents must

held from your income; and

If you are not eligible or you choose not to

have had at least $1 of Minnesota tax liabil-

use the optional short method, use the regu-

• the total you claim for the refundable

ity to use 100 percent of the prior year’s tax.

lar method to determine your underpay-

2014 Child and Dependent Care, Work-

ment penalty. Skip lines 7–12 and continue

Fiscal Year Taxpayers

ing Family, K-12 Education, Reading,

with line 13.

Internship, Angel Investment, Historic

If you fi le your Minnesota return on a fi scal

Structure Rehabilitation, and Job Oppor-

year basis, change the payment due dates to

Optional Short Method

tunity Building Zone (JOBZ) Jobs credits.

the 15th day of the fourth, sixth and ninth

Line 7

months of your fi scal year, and the fi rst

You do not have to pay an underpayment

Enter the total amount of 2014 estimated tax

month of your next fi scal year.

penalty if all of the following apply:

payments you made in 2014 and 2015. Do

• you did not have a Minnesota tax liability

Line Instructions

not include any other amounts on line 7.

on line 20 of your 2013 Form M1;

Th ese instructions refer to your original re-

Line 12

• you were a Minnesota resident for all of

turn. However, an amended return is consid-

Subtract line 11 from line 10. Th is is the

2013; and

ered the original return if it is fi led by the due

amount of your underpayment of estimated

date of the original return. Also, a joint Form

• your 2013 return covered a 12-month

tax penalty.

M1 that replaces previously fi led separate

period.

returns is considered the original return.

Enter this amount on line 33 of your 2014

Nonresidents and part-year residents.

Form M1.

Line 5

Determine your required annual payment

If you did not fi le a 2013 return, skip line 5

If you owe an amount on line 32 of Form

based on your Minnesota assignable ad-

and enter the amount from line 4 on line 6.

M1, add the penalty on line 12 of this

justed gross income.

schedule to the amount owed and replace

Enter the amount from line 20 of your 2013

Farmers and commercial fi shermen. If you

line 32 of Form M1 with the total.

Form M1, unless your 2013 federal adjusted

fi led Form M1 and paid your entire income

gross income (from line 37 of federal Form

If you have a refund on line 30 of Form

tax by March 1, 2015, or paid two-thirds of

1040 or line 21 of Form 1040A) was more

M1, subtract the penalty on line 12 of this

your income tax by January 15, 2015, you

than $150,000. Nonresidents and part-year

schedule from your refund and replace line

do not have to complete this schedule.

residents use Minnesota assignable adjusted

30 of Form M1 with the result.

You are considered a farmer or commercial

gross income.

fi sherman if two-thirds of your annual gross

Regular Method

If your 2013 federal adjusted gross income

income is earned by farming or commercial

Complete column A, lines 13–16. Th en,

was more than $150,000, multiply line 20 of

fi shing.

depending on whether you have an under-

your 2013 Form M1 by 110 percent (1.10).

payment or an overpayment, either continue

Exceptions to the Penalty

Enter the result on line 5 of Schedule M15.

with line 17 of column A (underpayment) or

If the Internal Revenue Service (IRS) does

line 13 of column B (overpayment).

Optional Short Method or

not require you to pay additional charges

Line 13

Regular Method

for underestimating your federal tax

Enter 25 percent (.25) of line 6 in each of

because you are newly retired or disabled,

You may use the optional short method only

the four columns on line 13, unless one of

or because of a casualty, disaster or other

if:

the three following conditions applies to

unusual circumstances, do not complete

• you did not make any estimated tax pay-

you:

Schedule M15. Include a copy of your fed-

ments (or your only payments were from

eral request with your Form M1.

1 Your taxable income was higher at some

Minnesota income tax withheld from

your wages); OR

times during the year and lower at others.

Avoiding the Penalty

• you paid your 2014 estimated tax in four

You may benefi t by fi guring your install-

To avoid an underpayment penalty of esti-

equal amounts on or before the due date

ments using the annualized income

mated tax, you must have had withholding

of each installment.

installment method. For example, if you

or made the required, timely estimated tax

payments and paid the lesser of:

Continued

1

1 2

2 3

3 4

4