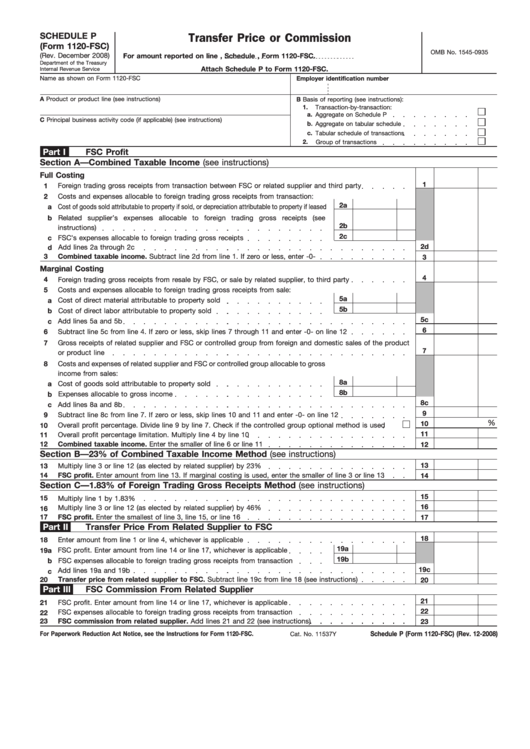

SCHEDULE P

Transfer Price or Commission

(Form 1120-FSC)

OMB No. 1545-0935

(Rev. December 2008)

For amount reported on line

, Schedule

, Form 1120-FSC.

Department of the Treasury

Attach Schedule P to Form 1120-FSC.

Internal Revenue Service

Name as shown on Form 1120-FSC

Employer identification number

A Product or product line (see instructions)

B Basis of reporting (see instructions):

1.

Transaction-by-transaction:

a.

Aggregate on Schedule P

C Principal business activity code (if applicable) (see instructions)

b.

Aggregate on tabular schedule

c. Tabular schedule of transactions

2.

Group of transactions

Part I

FSC Profit

Section A—Combined Taxable Income (see instructions)

Full Costing

1

1

Foreign trading gross receipts from transaction between FSC or related supplier and third party

2

Costs and expenses allocable to foreign trading gross receipts from transaction:

2a

a Cost of goods sold attributable to property if sold, or depreciation attributable to property if leased

b Related supplier’s expenses allocable to foreign trading gross receipts (see

2b

instructions)

2c

c FSC’s expenses allocable to foreign trading gross receipts

2d

d Add lines 2a through 2c

3

Combined taxable income. Subtract line 2d from line 1. If zero or less, enter -0-

3

Marginal Costing

4

4

Foreign trading gross receipts from resale by FSC, or sale by related supplier, to third party

5

Costs and expenses allocable to foreign trading gross receipts from sale:

5a

a Cost of direct material attributable to property sold

5b

b Cost of direct labor attributable to property sold

5c

c Add lines 5a and 5b

6

6

Subtract line 5c from line 4. If zero or less, skip lines 7 through 11 and enter -0- on line 12

7

Gross receipts of related supplier and FSC or controlled group from foreign and domestic sales of the product

7

or product line

8

Costs and expenses of related supplier and FSC or controlled group allocable to gross

income from sales:

8a

a Cost of goods sold attributable to property sold

8b

b Expenses allocable to gross income

8c

c Add lines 8a and 8b

9

9

Subtract line 8c from line 7. If zero or less, skip lines 10 and 11 and enter -0- on line 12

%

10

10

Overall profit percentage. Divide line 9 by line 7. Check if the controlled group optional method is used

11

11

Overall profit percentage limitation. Multiply line 4 by line 10

12

Combined taxable income. Enter the smaller of line 6 or line 11

12

Section B—23% of Combined Taxable Income Method (see instructions)

13

13

Multiply line 3 or line 12 (as elected by related supplier) by 23%

14

FSC profit. Enter amount from line 13. If marginal costing is used, enter the smaller of line 3 or line 13

14

Section C—1.83% of Foreign Trading Gross Receipts Method (see instructions)

15

15

Multiply line 1 by 1.83%

16

Multiply line 3 or line 12 (as elected by related supplier) by 46%

16

17

FSC profit. Enter the smallest of line 3, line 15, or line 16

17

Part II

Transfer Price From Related Supplier to FSC

18

18

Enter amount from line 1 or line 4, whichever is applicable

19a

19a FSC profit. Enter amount from line 14 or line 17, whichever is applicable

19b

b FSC expenses allocable to foreign trading gross receipts from transaction

19c

Add lines 19a and 19b

c

20

Transfer price from related supplier to FSC. Subtract line 19c from line 18 (see instructions)

20

Part III

FSC Commission From Related Supplier

21

21

FSC profit. Enter amount from line 14 or line 17, whichever is applicable

22

FSC expenses allocable to foreign trading gross receipts from transaction

22

23

FSC commission from related supplier. Add lines 21 and 22 (see instructions)

23

Schedule P (Form 1120-FSC) (Rev. 12-2008)

For Paperwork Reduction Act Notice, see the Instructions for Form 1120-FSC.

Cat. No. 11537Y

1

1 2

2 3

3