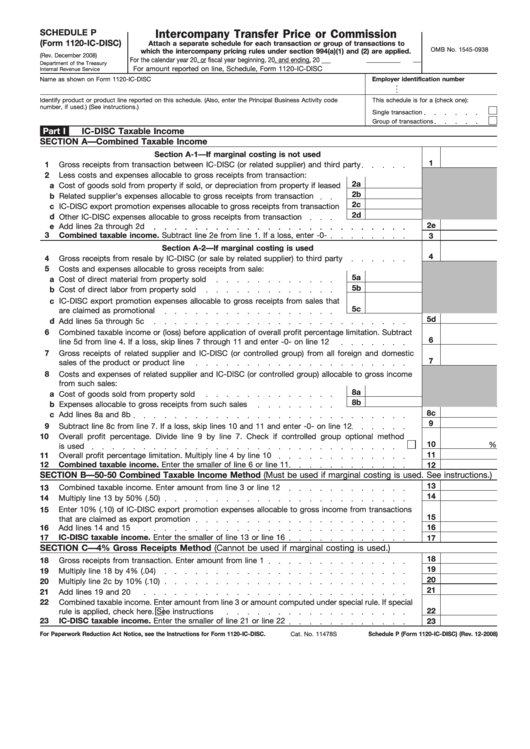

SCHEDULE P

Intercompany Transfer Price or Commission

(Form 1120-IC-DISC)

Attach a separate schedule for each transaction or group of transactions to

OMB No. 1545-0938

which the intercompany pricing rules under section 994(a)(1) and (2) are applied.

(Rev. December 2008)

For the calendar year 20

, or fiscal year beginning

, 20

, and ending

, 20

Department of the Treasury

For amount reported on line

, Schedule

, Form 1120-IC-DISC

Internal Revenue Service

Name as shown on Form 1120-IC-DISC

Employer identification number

Identify product or product line reported on this schedule. (Also, enter the Principal Business Activity code

This schedule is for a (check one):

number, if used.) (See instructions.)

Single transaction

Group of transactions

Part I

IC-DISC Taxable Income

SECTION A—Combined Taxable Income

Section A-1—If marginal costing is not used

1

1

Gross receipts from transaction between IC-DISC (or related supplier) and third party

2

Less costs and expenses allocable to gross receipts from transaction:

2a

a

Cost of goods sold from property if sold, or depreciation from property if leased

2b

b

Related supplier’s expenses allocable to gross receipts from transaction

2c

c

IC-DISC export promotion expenses allocable to gross receipts from transaction

2d

d

Other IC-DISC expenses allocable to gross receipts from transaction

2e

e Add lines 2a through 2d

3

Combined taxable income. Subtract line 2e from line 1. If a loss, enter -0-

3

Section A-2—If marginal costing is used

4

4

Gross receipts from resale by IC-DISC (or sale by related supplier) to third party

5

Costs and expenses allocable to gross receipts from sale:

5a

a

Cost of direct material from property sold

5b

b

Cost of direct labor from property sold

c

IC-DISC export promotion expenses allocable to gross receipts from sales that

5c

are claimed as promotional

5d

d

Add lines 5a through 5c

6

Combined taxable income or (loss) before application of overall profit percentage limitation. Subtract

6

line 5d from line 4. If a loss, skip lines 7 through 11 and enter -0- on line 12

7

Gross receipts of related supplier and IC-DISC (or controlled group) from all foreign and domestic

7

sales of the product or product line

8

Costs and expenses of related supplier and IC-DISC (or controlled group) allocable to gross income

from such sales:

8a

a

Cost of goods sold from property sold

8b

b

Expenses allocable to gross receipts from such sales

8c

c

Add lines 8a and 8b

9

9

Subtract line 8c from line 7. If a loss, skip lines 10 and 11 and enter -0- on line 12

10

Overall profit percentage. Divide line 9 by line 7. Check if controlled group optional method

10

%

is used

11

11

Overall profit percentage limitation. Multiply line 4 by line 10

12

Combined taxable income. Enter the smaller of line 6 or line 11

12

SECTION B—50-50 Combined Taxable Income Method (Must be used if marginal costing is used. See instructions.)

13

13

Combined taxable income. Enter amount from line 3 or line 12

14

14

Multiply line 13 by 50% (.50)

15

Enter 10% (.10) of IC-DISC export promotion expenses allocable to gross income from transactions

15

that are claimed as export promotion

16

16

Add lines 14 and 15

17

IC-DISC taxable income. Enter the smaller of line 13 or line 16

17

SECTION C—4% Gross Receipts Method (Cannot be used if marginal costing is used.)

18

18

Gross receipts from transaction. Enter amount from line 1

19

19

Multiply line 18 by 4% (.04)

20

20

Multiply line 2c by 10% (.10)

21

21

Add lines 19 and 20

22

Combined taxable income. Enter amount from line 3 or amount computed under special rule. If special

22

rule is applied, check here

. See instructions

23

IC-DISC taxable income. Enter the smaller of line 21 or line 22

23

For Paperwork Reduction Act Notice, see the Instructions for Form 1120-IC-DISC.

Cat. No. 11478S

Schedule P (Form 1120-IC-DISC) (Rev. 12-2008)

1

1 2

2