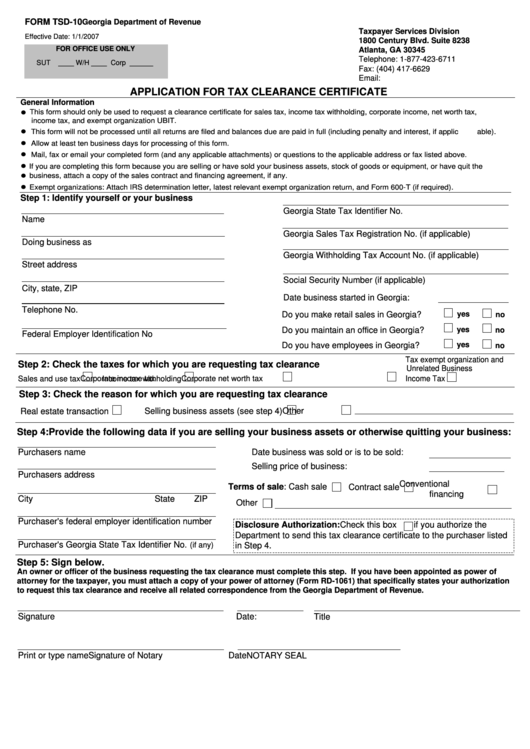

FORM TSD-10

Georgia Department of Revenue

Taxpayer Services Division

Effective Date: 1/1/2007

1800 Century Blvd. Suite 8238

FOR OFFICE USE ONLY

Atlanta, GA 30345

Print

Clear

Telephone: 1-877-423-6711

SUT

____ W/H ____ Corp ______

Fax: (404) 417-6629

Email: taxpayer.services@dor.ga.gov

APPLICATION FOR TAX CLEARANCE CERTIFICATE

General Information

●

This form should only be used to request a clearance certificate for sales tax, income tax withholding, corporate income, net worth tax,

income tax, and exempt organization UBIT.

●

This form will not be processed until all returns are filed and balances due are paid in full (including penalty and interest, if applic able).

●

Allow at least ten business days for processing of this form.

●

Mail, fax or email your completed form (and any applicable attachments) or questions to the applicable address or fax listed above.

●

If you are completing this form because you are selling or have sold your business assets, stock of goods or equipment, or have quit the

●

business, attach a copy of the sales contract and financing agreement, if any.

●

Exempt organizations: Attach IRS determination letter, latest relevant exempt organization return, and Form 600-T (if required).

Step 1: Identify yourself or your business

Georgia State Tax Identifier No.

Name

Georgia Sales Tax Registration No. (if applicable)

Doing business as

Georgia Withholding Tax Account No. (if applicable)

Street address

Social Security Number (if applicable)

City, state, ZIP

Date business started in Georgia:

Telephone No.

yes

Do you make retail sales in Georgia?

no

yes

Do you maintain an office in Georgia?

no

Federal Employer Identification No

yes

Do you have employees in Georgia?

no

Tax exempt organization and

Step 2: Check the taxes for which you are requesting tax clearance

Unrelated Business

Sales and use tax

Income tax withholding

Corporate income tax

Corporate net worth tax

Income Tax

Step 3: Check the reason for which you are requesting tax clearance

Other

Real estate transaction

Selling business assets (see step 4)

Step 4:Provide the following data if you are selling your business assets or otherwise quitting your business:

Purchasers name

Date business was sold or is to be sold:

Selling price of business:

Purchasers address

Conventional

Terms of sale: Cash sale

Contract sale

financing

City

State

ZIP

Other

Purchaser's federal employer identification number

Disclosure Authorization: Check this box

if you authorize the

Department to send this tax clearance certificate to the purchaser listed

Purchaser's Georgia State Tax Identifier No.

(if any)

in Step 4.

Step 5: Sign below.

An owner or officer of the business requesting the tax clearance must complete this step. If you have been appointed as power of

attorney for the taxpayer, you must attach a copy of your power of attorney (Form RD-1061) that specifically states your authorization

to request this tax clearance and receive all related correspondence from the Georgia Department of Revenue.

Signature

Date:

Title

Print or type name

Signature of Notary

Date

NOTARY SEAL

1

1