Electronic Funds Transfer Authorization Agreement

ADVERTISEMENT

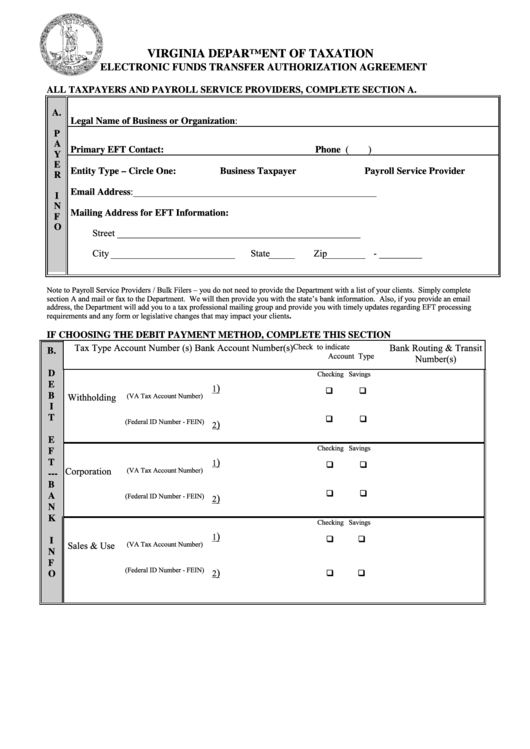

VIRGINIA DEPARTMENT OF TAXATION

ELECTRONIC FUNDS TRANSFER AUTHORIZATION AGREEMENT

ALL TAXPAYERS AND PAYROLL SERVICE PROVIDERS, COMPLETE SECTION A.

A.

Legal Name of Business or Organization:

P

A

Phone (

)

Primary EFT Contact:

Y

E

Entity Type – Circle One:

Business Taxpayer

Payroll Service Provider

R

Email Address:___________________________________________________

I

N

Mailing Address for EFT Information:

F

O

Street ___________________________________________________

City

State

Zip

- _________

Note to Payroll Service Providers / Bulk Filers – you do not need to provide the Department with a list of your clients. Simply complete

section A and mail or fax to the Department. We will then provide you with the state’s bank information. Also, if you provide an email

address, the Department will add you to a tax professional mailing group and provide you with timely updates regarding EFT processing

requirements and any form or legislative changes that may impact your clients.

IF CHOOSING THE DEBIT PAYMENT METHOD, COMPLETE THIS SECTION

Check to indicate

Tax Type

Account Number (s) Bank Account Number(s)

Bank Routing & Transit

B.

Account Type

Number(s)

D

Checking Savings

E

)

1

B

Withholding

(VA Tax Account Number)

I

T

)

2

(Federal ID Number - FEIN)

E

Checking Savings

F

)

1

T

Corporation

(VA Tax Account Number)

---

B

A

)

2

(Federal ID Number - FEIN)

N

K

Checking Savings

)

1

I

(VA Tax Account Number)

Sales & Use

N

F

)

(Federal ID Number - FEIN)

2

O

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2