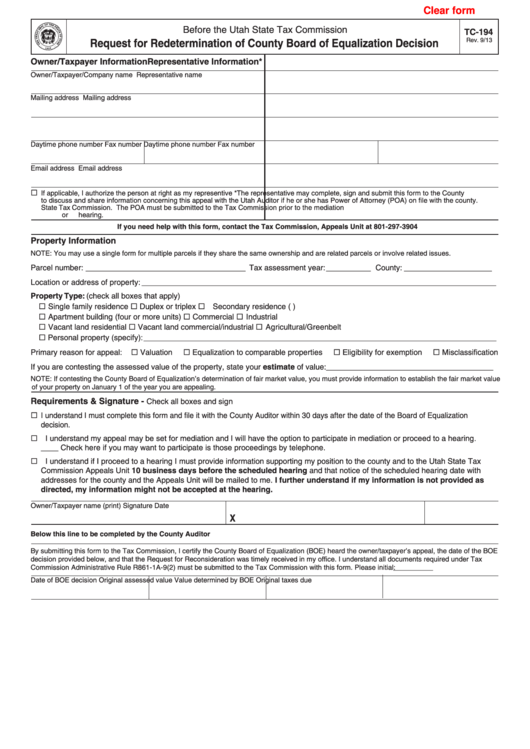

Clear form

Before the Utah State Tax Commission

TC-194

Rev. 9/13

Request for Redetermination of County Board of Equalization Decision

Owner/Taxpayer Information

Representative Information*

Owner/Taxpayer/Company name

Representative name

Mailing address

Mailing address

Daytime phone number

Fax number

Daytime phone number

Fax number

Email address

Email address

If applicable, I authorize the person at right as my representive

*The representative may complete, sign and submit this form to the County

to discuss and share information concerning this appeal with the Utah

Auditor if he or she has Power of Attorney (POA) on file with the county.

State Tax Commission.

The POA must be submitted to the Tax Commission prior to the mediation

or hearing.

If you need help with this form, contact the Tax Commission, Appeals Unit at 801-297-3904

Property Information

NOTE: You may use a single form for multiple parcels if they share the same ownership and are related parcels or involve related issues.

Parcel number: __ ___ ___ _ _ _ _ _ _ _ _ _ _ _ _ _ _ Tax assessment year: ______ County: ________ __ __

Location or address of property:_ _ _ _ _ _ _ _ _ _ _ _ ___ __ ___ ________________________ ___ __

Property Type: (check all boxes that apply)

Single family residence

Duplex or triplex

Secondary residence (e.g. cabin)

Apartment building (four or more units)

Commercial

Industrial

Vacant land residential

Vacant land commercial/industrial

Agricultural/Greenbelt

Personal property (specify):_________________________________________________

Valuation

Equalization to comparable properties

Eligibility for exemption

Misclassification

Primary reason for appeal:

If you are contesting the assessed value of the property, state your estimate of value: __________________ __ __ _

NOTE: If contesting the County Board of Equalization’s determination of fair market value, you must provide information to establish the fair market value

of your property on January 1 of the year you are appealing.

Requirements & Signature -

Check all boxes and sign

I understand I must complete this form and file it with the County Auditor within 30 days after the date of the Board of Equalization

decision.

I understand my appeal may be set for mediation and I will have the option to participate in mediation or proceed to a hearing.

____ Check here if you may want to participate is those proceedings by telephone.

I understand if I proceed to a hearing I must provide information supporting my position to the county and to the Utah State Tax

Commission Appeals Unit 10 business days before the scheduled hearing and that notice of the scheduled hearing date with

addresses for the county and the Appeals Unit will be mailed to me. I further understand if my information is not provided as

directed, my information might not be accepted at the hearing.

Owner/Taxpayer name (print)

Signature

Date

X

Below this line to be completed by the County Auditor

By submitting this form to the Tax Commission, I certify the County Board of Equalization (BOE) heard the owner/taxpayer’s appeal, the date of the BOE

decision provided below, and that the Request for Reconsideration was timely received in my office. I understand all documents required under Tax

Commission Administrative Rule R861-1A-9(2) must be submitted to the Tax Commission with this form. Please initial: _ __ __ _

Date of BOE decision

Original assessed value

Value determined by BOE

Original taxes due

1

1