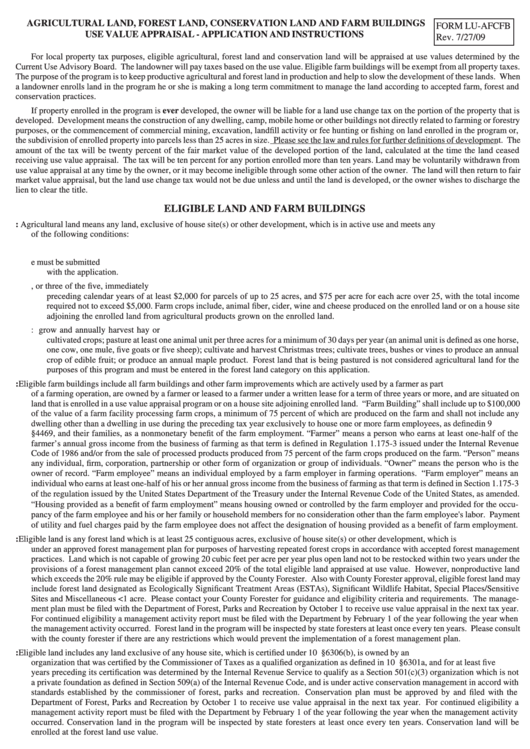

AGRICULTURAL LAND, FOREST LAND, CONSERVATION LAND AND FARM BUILDINGS

FORM LU-AFCFB

USE VALUE APPRAISAL - APPLICATION AND INSTRUCTIONS

Rev. 7/27/09

For local property tax purposes, eligible agricultural, forest land and conservation land will be appraised at use values determined by the

Current Use Advisory Board. The landowner will pay taxes based on the use value. Eligible farm buildings will be exempt from all property taxes.

The purpose of the program is to keep productive agricultural and forest land in production and help to slow the development of these lands. When

a landowner enrolls land in the program he or she is making a long term commitment to manage the land according to accepted farm, forest and

conservation practices.

If property enrolled in the program is ever developed, the owner will be liable for a land use change tax on the portion of the property that is

developed. Development means the construction of any dwelling, camp, mobile home or other buildings not directly related to farming or forestry

purposes, or the commencement of commercial mining, excavation, landfill activity or fee hunting or fishing on land enrolled in the program or,

the subdivision of enrolled property into parcels less than 25 acres in size. Please see the law and rules for further definitions of development. The

amount of the tax will be twenty percent of the fair market value of the developed portion of the land, calculated at the time the land ceased

receiving use value appraisal. The tax will be ten percent for any portion enrolled more than ten years. Land may be voluntarily withdrawn from

use value appraisal at any time by the owner, or it may become ineligible through some other action of the owner. The land will then return to fair

market value appraisal, but the land use change tax would not be due unless and until the land is developed, or the owner wishes to discharge the

lien to clear the title.

ELIGIBLE LAND AND FARM BUILDINGS

A. Agricultural Land: Agricultural land means any land, exclusive of house site(s) or other development, which is in active use and meets any

of the following conditions:

1. It is owned by a farmer and is part of the farm unit.

2. It is leased to a farmer as part of his farming operation under a written lease for at least three years. A copy of the lease must be submitted

with the application.

3. It has and will continue to produce an annual gross income from the sale of farm crops in one of two, or three of the five, immediately

preceding calendar years of at least $2,000 for parcels of up to 25 acres, and $75 per acre for each acre over 25, with the total income

required not to exceed $5,000. Farm crops include, animal fiber, cider, wine and cheese produced on the enrolled land or on a house site

adjoining the enrolled land from agricultural products grown on the enrolled land.

4. It is at least 25 contiguous acres and in active use to do one or a combination of the following: grow and annually harvest hay or

cultivated crops; pasture at least one animal unit per three acres for a minimum of 30 days per year (an animal unit is defined as one horse,

one cow, one mule, five goats or five sheep); cultivate and harvest Christmas trees; cultivate trees, bushes or vines to produce an annual

crop of edible fruit; or produce an annual maple product. Forest land that is being pastured is not considered agricultural land for the

purposes of this program and must be entered in the forest land category on this application.

B. Farm Buildings: Eligible farm buildings include all farm buildings and other farm improvements which are actively used by a farmer as part

of a farming operation, are owned by a farmer or leased to a farmer under a written lease for a term of three years or more, and are situated on

land that is enrolled in a use value appraisal program or on a house site adjoining enrolled land. “Farm Building” shall include up to $100,000

of the value of a farm facility processing farm crops, a minimum of 75 percent of which are produced on the farm and shall not include any

dwelling other than a dwelling in use during the preceding tax year exclusively to house one or more farm employees, as defined in 9 V.S.A.

§4469, and their families, as a nonmonetary benefit of the farm employment. “Farmer” means a person who earns at least one-half of the

farmer’s annual gross income from the business of farming as that term is defined in Regulation 1.175-3 issued under the Internal Revenue

Code of 1986 and/or from the sale of processed products produced from 75 percent of the farm crops produced on the farm. “Person” means

any individual, firm, corporation, partnership or other form of organization or group of individuals. “Owner” means the person who is the

owner of record. “Farm employee” means an individual employed by a farm employer in farming operations. “Farm employer” means an

individual who earns at least one-half of his or her annual gross income from the business of farming as that term is defined in Section 1.175-3

of the regulation issued by the United States Department of the Treasury under the Internal Revenue Code of the United States, as amended.

“Housing provided as a benefit of farm employment” means housing owned or controlled by the farm employer and provided for the occu-

pancy of the farm employee and his or her family or household members for no consideration other than the farm employee's labor. Payment

of utility and fuel charges paid by the farm employee does not affect the designation of housing provided as a benefit of farm employment.

C. Forest Land: Eligible land is any forest land which is at least 25 contiguous acres, exclusive of house site(s) or other development, which is

under an approved forest management plan for purposes of harvesting repeated forest crops in accordance with accepted forest management

practices. Land which is not capable of growing 20 cubic feet per acre per year plus open land not to be restocked within two years under the

provisions of a forest management plan cannot exceed 20% of the total eligible land appraised at use value. However, nonproductive land

which exceeds the 20% rule may be eligible if approved by the County Forester. Also with County Forester approval, eligible forest land may

include forest land designated as Ecologically Significant Treatment Areas (ESTAs), Significant Wildlife Habitat, Special Places/Sensitive

Sites and Miscellaneous <1 acre. Please contact your County Forester for guidance and eligibility criteria and requirements. The manage-

ment plan must be filed with the Department of Forest, Parks and Recreation by October 1 to receive use value appraisal in the next tax year.

For continued eligibility a management activity report must be filed with the Department by February 1 of the year following the year when

the management activity occurred. Forest land in the program will be inspected by state foresters at least once every ten years. Please consult

with the county forester if there are any restrictions which would prevent the implementation of a forest management plan.

D. Conservation Land: Eligible land includes any land exclusive of any house site, which is certified under 10 V.S.A. §6306(b), is owned by an

organization that was certified by the Commissioner of Taxes as a qualified organization as defined in 10 V.S.A. §6301a, and for at least five

years preceding its certification was determined by the Internal Revenue Service to qualify as a Section 501(c)(3) organization which is not

a private foundation as defined in Section 509(a) of the Internal Revenue Code, and is under active conservation management in accord with

standards established by the commissioner of forest, parks and recreation. Conservation plan must be approved by and filed with the

Department of Forest, Parks and Recreation by October 1 to receive use value appraisal in the next tax year. For continued eligibility a

management activity report must be filed with the Department by February 1 of the year following the year when the management activity

occurred. Conservation land in the program will be inspected by state foresters at least once every ten years. Conservation land will be

enrolled at the forest land use value.

THE APPLICATION PROCESS

A separate application form must be submitted for each noncontiguous parcel.

By September 1, for agricultural, forest land, conservation land and farm buildings, fill out this application form for use value appraisal

of your property for next year and submit it to Property Valuation and Review. All information must be provided or the application will be

rejected. For parcels that contain ONLY agricultural land and farm buildings, enclose 3 copies of a map of your property that are to state

standards (see standards below). Also enclose a check for the application fee for $40.00 made payable to Property Valuation and Review.

By October 1, for parcels that are conservation land, forest management or combined forest management and agricultural land, the

applicant must submit to the Department of Forest, Parks and Recreation a conservation or forest management plan and 3 copies of a map of

1

1 2

2 3

3