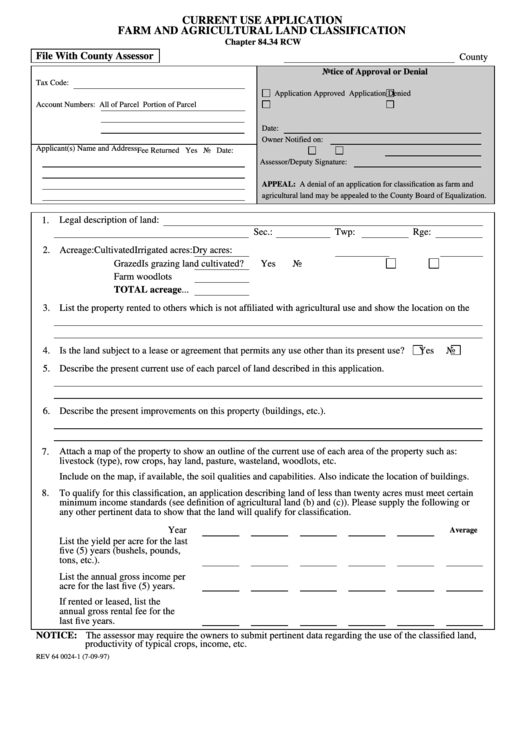

CURRENT USE APPLICATION

FARM AND AGRICULTURAL LAND CLASSIFICATION

Chapter 84.34 RCW

File With County Assessor

County

Notice of Approval or Denial

Tax Code:

Application Approved

Application Denied

Account Numbers:

All of Parcel

Portion of Parcel

Date:

Owner Notified on:

Applicant(s) Name and Address

Fee Returned

Yes

No Date:

Assessor/Deputy Signature:

APPEAL: A denial of an application for classification as farm and

agricultural land may be appealed to the County Board of Equalization.

1. Legal description of land:

Sec.:

Twp:

Rge:

2. Acreage:

Cultivated...............

Irrigated acres:

Dry acres:

Grazed....................

Is grazing land cultivated?

Yes

No

Farm woodlots .......

TOTAL acreage ...

3. List the property rented to others which is not affiliated with agricultural use and show the location on the

4. Is the land subject to a lease or agreement that permits any use other than its present use?

Yes

No

5. Describe the present current use of each parcel of land described in this application.

6. Describe the present improvements on this property (buildings, etc.).

7. Attach a map of the property to show an outline of the current use of each area of the property such as:

livestock (type), row crops, hay land, pasture, wasteland, woodlots, etc.

Include on the map, if available, the soil qualities and capabilities. Also indicate the location of buildings.

8. To qualify for this classification, an application describing land of less than twenty acres must meet certain

minimum income standards (see definition of agricultural land (b) and (c)). Please supply the following or

any other pertinent data to show that the land will qualify for classification.

Year

Average

List the yield per acre for the last

five (5) years (bushels, pounds,

tons, etc.).

List the annual gross income per

acre for the last five (5) years.

If rented or leased, list the

annual gross rental fee for the

last five years.

NOTICE: The assessor may require the owners to submit pertinent data regarding the use of the classified land,

productivity of typical crops, income, etc.

REV 64 0024-1 (7-09-97)

1

1 2

2