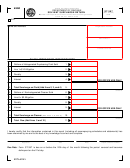

Form St-397 - Solvent Surcharge Return Page 2

ADVERTISEMENT

INSTRUCTIONS

Wholesale solvent supply facilities must remit a surcharge on solvent used for drycleaning purposes when the products

are first imported into or produced in the state.

Line 1:

Enter the total number of gallons of halogenated drycleaning fluid sold or produced in the state.

Line 2:

Multiply by the surcharge rate of $10.00 per gallon. Enter the surcharge amount.

Line 3:

Add penalty. (See penalty and interest calculations below.)

Line 4:

Add interest. (See penalty and interest calculations below.)

Line 5:

Enter the total surcharge, penalty and interest on fluid.

Line 6:

Enter the total number of gallons of nonhalogenated cleaner sold or produced in the state.

Line 7:

Multiply by the surcharge rate of $2.00 per gallon. Enter the surcharge amount.

Line 8:

Add penalty. (See penalty and interest calculations below.)

Line 9:

Add interest. (See penalty and interest calculations below.)

Line 10:

Enter the total surcharge, penalty and interest on cleaner.

Line 11:

Enter the total solvent surcharge due, Line 5 + Line 10.

PENALTY AND INTEREST CALCULATIONS

PENALTY FOR FAILURE TO FILE A RETURN: Five percent (.05) of the amount of surcharge due (from lines 2 and/or 7

on the front of the return) for each month or fraction of a month of delinquency, not to exceed twenty-five percent (.25) of

the amount of tax due.

PENALTY FOR FAILURE TO PAY TAX DUE: The penalty is one-half of one percent (.005) of the amount of surcharge

due (the total of lines 2 and/or 7 on the front of the return) for each month or fraction of month of delinquency, not to

exceed a total of twenty-five percent (.25) of the amount to surcharge due. The penalties for failure to file a return and

failure to pay tax due must be combined and entered as a total on lines 3 and/or 8.

INTEREST: Interest is assessed in accordance with Sections 6621 and 6622 of the Internal Revenue Code. Rates are

based on the prime rate, subject to change quarterly and are compounded daily.

NOTE: To compute penalty and interest electronically, visit our website at and Interest

Calculator

Taxpayers' Bill Of Rights

You have the right to apply for assistance from the Taxpayer Rights' Advocate within the Department of Revenue. The

advocate or his designee is responsible for facilitating resolution of taxpayer complaints and problems.

You have the right to request and receive forms, instructions and other written materials in plain, easy-to-understand

language.

You have the right to prompt, courteous service from us in all your dealings with the Department of Revenue.

You have the right to request and receive written information guides, which explain in simple and nontechnical language,

appeal procedures and your remedies as a taxpayer.

You have the right to receive notices which contain descriptions of the basis for and identification of amounts of any tax,

interest and penalties due.

Under the provisions of Section 12-4-340 of the 1976 code of laws, any outstanding liabilities due and owing to South

Carolina Department of Revenue for more than 6 months may be assigned to a private collection agency for collecting

actions.

50762012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2