Form St-394 - Rental Surcharge Return - South Carolina Department Of Revenue

ADVERTISEMENT

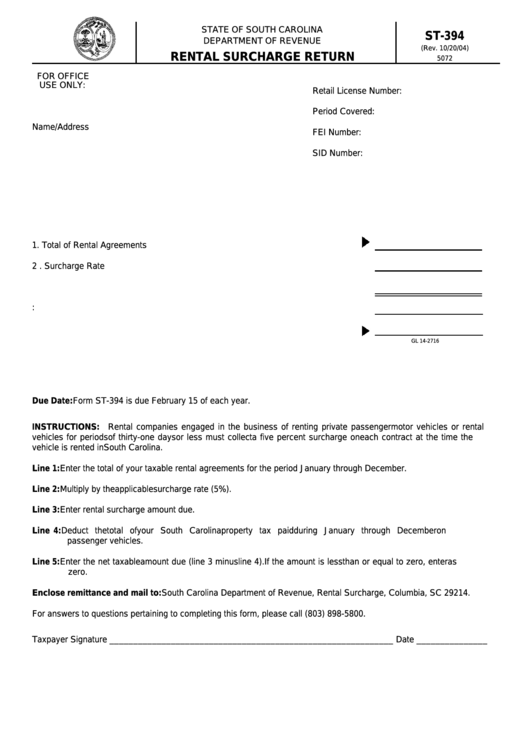

STATE OF SOUTH CAROLINA

ST-394

DEPARTMENT OF REVENUE

(Rev. 10/20/04)

RENTAL SURCHARGE RETURN

5072

FOR OFFICE

USE ONLY:

Retail License Number:

Period Covered:

Name/Address

FEI Number:

SID Number:

1. Total of Rental Agreements .....................................................................................

2 . Surcharge Rate ......................................................................................................

X

.05

3. Surcharge Due .......................................................................................................

4. Less: S.C. Property Tax Paid .................................................................................

5. Net Taxable Due ....................................................................................................

GL 14-2716

Due Date: Form ST-394 is due February 15 of each year.

INSTRUCTIONS: Rental companies engaged in the business of renting private passenger motor vehicles or rental

vehicles for periods of thirty-one days or less must collect a five percent surcharge on each contract at the time the

vehicle is rented in South Carolina.

Line 1: Enter the total of your taxable rental agreements for the period January through December.

Line 2: Multiply by the applicable surcharge rate (5%).

Line 3: Enter rental surcharge amount due.

Line 4: Deduct the total of your South Carolina property tax paid during January through December on

passenger vehicles.

Line 5: Enter the net taxable amount due (line 3 minus line 4). If the amount is less than or equal to zero, enter as

zero.

Enclose remittance and mail to: South Carolina Department of Revenue, Rental Surcharge, Columbia, SC 29214.

For answers to questions pertaining to completing this form, please call (803) 898-5800.

Taxpayer Signature ____________________________________________________________ Date _______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1