Form 12339-A - Tax Check Waiver Page 2

Download a blank fillable Form 12339-A - Tax Check Waiver in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 12339-A - Tax Check Waiver with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

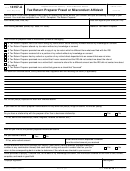

Comments (If you answered ''Yes'' to any question on page one (1), please explain why)

I authorize the IRS to release any additional relevant information necessary to respond to the questions on page one (1).

To help the IRS find my tax records, I am voluntarily providing the following information (please type or print).

Name

Social Security Number

Home street address

City

State

ZIP Code

Home telephone number

Business/Work telephone number

Applicant signature (Signature of the applicant authorizing the disclosure of confidential tax information)

Date signed (This consent is valid only if received by the IRS within sixty (60) calendar days of this date)

If you are married and file a joint Federal tax return, your Spouse must provide the following information

Spouse's name

Social Security Number

Spouse's signature (Signature of the spouse authorizing the disclosure of confidential tax information)

Date signed (This consent is valid only if received by the IRS within sixty (60) calendar days of this date)

PRIVACY ACT STATEMENT

The Privacy Act of 1974 requires that when we ask you information about yourself, we state our legal right to do so, tell you why we are

asking for it, and how it will be used. We must also tell you what could happen if we do not receive it , and whether your response is

voluntary, required to obtain a benefit, or mandatory. Our legal right to ask you for the information is 5 U.S.C. 301 and Executive Order

(E.O.) 9397. We are asking for this information to determine your suitability as an employee (direct hire or contracted), consultant or

advisor of the Internal Revenue Service.

If you do not provide us with this information, it may adversely affect our ability to consider you. Any adverse information will be shared

with the appropriate IRS office(s) and may be disclosed to other federal agencies as required by law. Requesting your Social Security

Number, under authority E.O. 9397, is also voluntary and no right, benefit, or privilege provided by law will be denied as a result of

refusal to disclose it.

12339-A

Form

(Rev. 5-2006)

Catalog Number 28321A

Department of the Treasury-Internal Revenue Service

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2