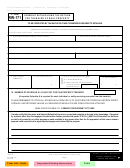

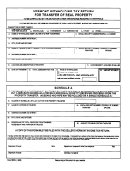

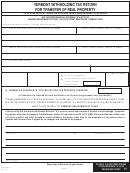

VERMONT WITHHOLDING TAX RETURN

FOR TRANSFER OF REAL PROPERTY (Form RW-171)

4. The seller is a mortgagor conveying the mortgaged

GENERAL INFORMATION

property to a mortgagee in a foreclosure or transfer in

PURPOSE OF FORM - A 2.5% withholding obligation is

lieu of foreclosure, with no additional consideration.

imposed on the buyer or other transferee (referred to herein as

Please check the applicable box on the Property Transfer Tax

“buyer”) when Vermont real property is acquired from a

Return Withholding Certification section (page 3 of the form) if

nonresident of Vermont. The buyer must withhold 2.5% of the

one of these exemptions applies.

consideration paid for the property. If the buyer fails to withhold,

the buyer will be personally liable for the amount required to be

WITHHOLDING CERTIFICATE ISSUED BY THE

withheld.

COMMISSIONER OF TAXES - A withholding certificate may

be issued by the Commissioner of Taxes to reduce or eliminate

WHO MUST FILE - A buyer of a Vermont real property interest,

withholding on transfers of Vermont real property interests by

including a corporation, limited liability company, partnership or

nonresidents. A certificate may be issued if:

fiduciary that is required to withhold tax, must file Form RW-171.

If two or more persons are joint buyers, each of them is

1. No tax is due on the gain from the transfer;

obligated to withhold. However, the obligation of each will be

2. The seller or buyer has provided adequate security to

met if one of the joint buyers withholds and transmits the

cover the tax liability;

required amount to the Commissioner of Taxes.

3. Reduced withholding is appropriate because the 2.5%

A nonresident individual is one who is domiciled outside the

amount exceeds the seller’s maximum tax liability;

state at the time of closing. A Partnership, Limited Liability

Company or a Subchapter S Corporation is deemed to be a

4. Reduced withholding is appropriate to reflect the gain

nonresident of Vermont if the controlling interest is held by

allocated to a Vermont resident when there are both

nonresidents. A Corporation (other than a Subchapter S

Vermont resident and nonresident sellers.

Corporation) that was incorporated outside Vermont is a

To obtain a certificate that no tax is due, or that a reduced

nonresident unless it has its principal place of business in

amount may be withheld, call (802) 828-6680.

Vermont and does no business in the state of incorporation.

LINE-BY-LINE INSTRUCTIONS

WHEN TO FILE - A buyer must report and transmit the tax

withheld to the Commissioner of Taxes within 30 days after the

(Use Blue or Black ink Only)

date of transfer.

Form RW-171 is a two-page form. Please submit page 1

WHERE TO FILE - File Form RW-171 directly with the

(signature page) and page 2 (Schedule A) together. Failure to

Commissioner of Taxes, Vermont Department of Taxes, 133

do so will result in form being returned to buyer.

State Street, Montpelier, VT 05633. Do not file this return with

Lines 1-8. Enter the name, address, social security number or

the town clerk.

federal ID number of each withholding agent (buyer).

EXEMPTIONS - The buyer is not required to withhold or file this

Line 9. Enter the location of the property, including town and

return if one of the following applies:

street address.

1. At the time of the transfer, the seller certifies to the

Line 10. Enter the date the property was acquired by the seller.

buyer on the Property Transfer Tax Return, under

Line 11. Enter the date of this transfer.

penalty of perjury, the transferor’s social security

number and the fact that each seller is a Vermont

Line 12. Enter the total contract sales price.

resident or an estate.

Line 13. Check the appropriate box to indicate the amount

2. The buyer or seller has obtained a certificate from the

withheld. If the parties obtained a withholding certificate from

Commissioner of Taxes in advance of the sale, stating

the Commissioner of Taxes authorizing a reduced rate of

that no income tax is due or that the parties have

withholding, enter the certificate number and attach a copy of

provided adequate security to cover the liability.

the certificate to the return.

3. The buyer certifies on the Property Transfer Tax

Line 14. Enter the dollar amount withheld.

Return that this is a transfer without consideration. A

Line 15. Enter the number of Schedule “A”s filled out for this

transaction is NOT exempt if consideration is paid.

property transfer. A separate Schedule “A” is required for each

Consideration paid includes the value of services or

individual or entity receiving proceeds from the transfer.

goods, forgiveness of debt, or other items which are

deemed consideration under the Internal Revenue

Code.

22

1

1 2

2 3

3 4

4