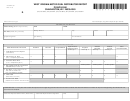

WV/MFT-501

WEST VIRGINIA MOTOR FUEL DISTRIBUTOR REPORT

Filing Information

OVERVIEW:

REQUIRED SCHEDULES

Schedule 1

- Schedule of Tax-Paid Receipts

- PROVIDE ALL INFORMATION REQUESTED ON THIS REPORT.

Schedule 2

- Schedule of Untaxed Receipts

- Your report must be postmarked by the

Last Day of the month following the report month.

Schedule 5

- Schedule of Tax Collected Disbursements

- ATTACH ALL REQUIRED SCHEDULES.

Schedule 5X

- Schedule of motor fuel exempt from flat rate

sold for use on highway

Instructions for Completing Section 1 Lines 1 through 10

Line 1

For each product type, enter the number of gallons received Tax Unpaid.

NOTE -

You must file a Distributor Schedule of Tax-Unpaid Receipts Schedule 2.

Line 2

Combined Rate for Motor Fuels

Line 3

Tax Due; enter the result of the following: Multiply Lines 1 and 2.

Line 4

For each product type, enter the number of gallons received Tax Unpaid, subject to the variable rate.

NOTE -

You must file a Distributor Schedule of Tax-Unpaid Receipts Schedule 2.

Line 5

Variable Rate for Motor Fuels

Line 6

For each product type, enter the result of the following: Multiply Lines 4 and 5

Line 7

Enter invoiced gallons of fuel exempt from the flat rate used for taxable purpose (on-highway).

NOTE -

You must file a Distributor Schedule of On-Highway Exempt Fuel Disbursements (Schedule 5X) for motor fuel exempt

from the flat rate tax and used on highway. Total invoiced gallons from Schedule 5X must match Line 7 on the front of this report.

Line 8

Flat Rate for Motor Fuels

Line 9

Fuel exempt from flat rate sold for taxable use tax due; enter the result of the following, Line 7 multiplied by

Flat Rate on Line 8.

Line 10

Tax Due; enter the result of the following: Add Lines 6 and 9.

Instructions for Completing Section 2 Lines 1 through 4

Line 1

Balance of Tax Due. Sum of Section 1 Line 3 and Line 10 all columns.

Line 2

Non-Waivable Interest

Line 3

In addition to interest, a penalty of 5% per month (not to exceed 25%) is imposed if the return is late. Multiply Line 1 by 0.05 by

the number of months late. If no tax is due, a late filing penalty of $50 per month for each month or part of a month after

the due date must be remitted.

Line 4

Total Tax and Late Filing Charges Due. Add Lines 1 through 3.

Sign Your Return

Under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge

and belief it is true and complete.

(Name of Taxpayer - Type or Print)

(Title)

(Date)

(Signature of Taxpayer)

(Person to Contact Concerning this Return)

(Telephone Number)

(E-mail Address)

(Signature of preparer other than taxpayer)

(Address)

(Date)

Page 2 of 2

1

1 2

2