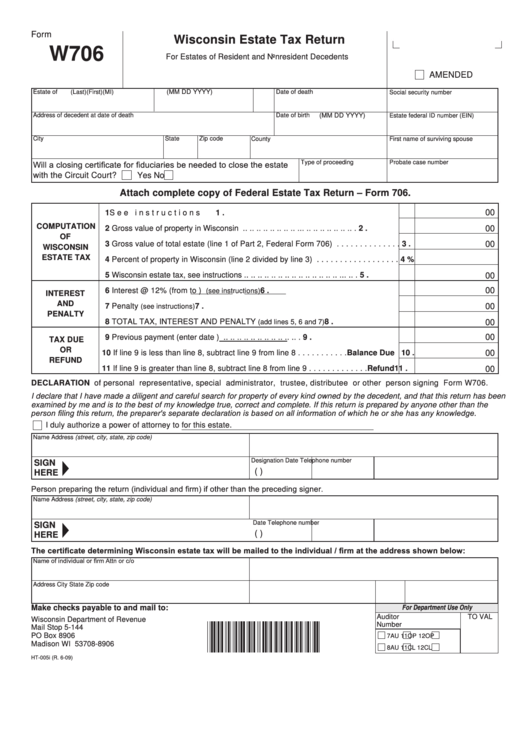

Form

Wisconsin Estate Tax Return

W706

For Estates of Resident and Nonresident Decedents

AMENDED

Date of death

(MM DD YYYY)

Estate of

(Last)

(First)

(MI)

Social security number

Address of decedent at date of death

Date of birth

(MM DD YYYY)

Estate federal ID number (EIN)

City

State

Zip code

County

First name of surviving spouse

Will a closing certificate for fiduciaries be needed to close the estate

Type of proceeding

Probate case number

with the Circuit Court?

Yes

No

Attach complete copy of Federal Estate Tax Return – Form 706.

00

1 See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

.

COMPUTATION

2 Gross value of property in Wisconsin . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

.

00

OF

00

3 Gross value of total estate (line 1 of Part 2, Federal Form 706) . . . . . . . . . . . . . . 3

.

WISCONSIN

ESTATE TAX

4 Percent of property in Wisconsin (line 2 divided by line 3) . . . . . . . . . . . . . . . . . . 4

%

5 Wisconsin estate tax, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

.

00

00

6 Interest @ 12% (from

to

)

. . . . . . . . . . . 6

.

(see instructions)

INTEREST

AND

7 Penalty

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

.

00

(see instructions)

PENALTY

8 TOTAL TAX, INTEREST AND PENALTY

. . . . . . . . . . . . . . . . 8

.

00

(add lines 5, 6 and 7)

00

9 Previous payment (enter date

) . . . . . . . . . . . . . . . . . . . . . . . 9

.

TAX DUE

OR

10 If line 9 is less than line 8, subtract line 9 from line 8 . . . . . . . . . . . Balance Due 10

.

00

REFUND

11 If line 9 is greater than line 8, subtract line 8 from line 9 . . . . . . . . . . . . . Refund 11

.

00

DECLARATION of personal representative, special administrator, trustee, distributee or other person signing Form W706 .

I declare that I have made a diligent and careful search for property of every kind owned by the decedent, and that this return has been

examined by me and is to the best of my knowledge true, correct and complete. If this return is prepared by anyone other than the

person filing this return, the preparer's separate declaration is based on all information of which he or she has any knowledge.

I duly authorize a power of attorney to

for this estate .

Name

Address (street, city, state, zip code)

Designation

Date

Telephone number

SIGN

(

)

HERE

Person preparing the return (individual and firm) if other than the preceding signer.

Name

Address (street, city, state, zip code)

Date

Telephone number

SIGN

(

)

HERE

The certificate determining Wisconsin estate tax will be mailed to the individual / firm at the address shown below:

Name of individual or firm

Attn or c/o

Address

City

State

Zip code

For Department Use Only

Make checks payable to and mail to:

Auditor

TO VAL

Wisconsin Department of Revenue

*E1TR09991*

Number

Mail Stop 5-144

PO Box 8906

7AU

11OP

12OP

Madison WI 53708-8906

8AU

11CL

12CL

HT-005i (R . 6-09)

1

1