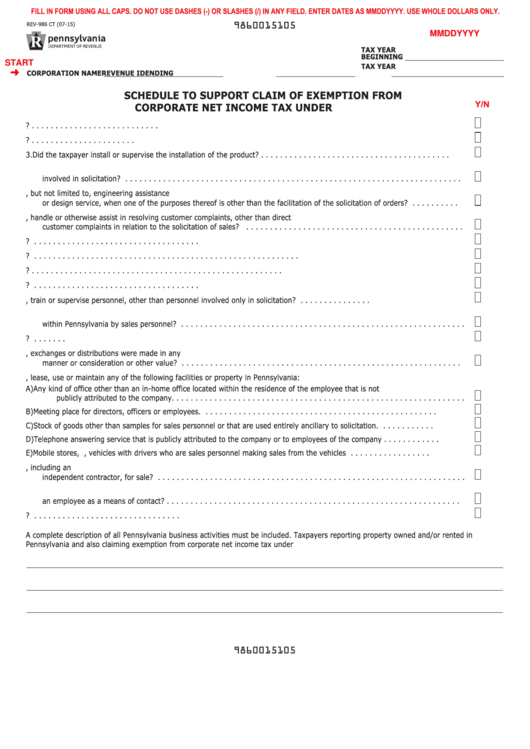

FILL IN FORM USING ALL CAPS. DO NOT USE DASHES (-) OR SLASHES (/) IN ANY FIELD. ENTER DATES AS MMDDYYYY. USE WHOLE DOLLARS ONLY.

REV-986 CT (07-15)

9 60015105

MMDDYYYY

Tax Year

BeGINNING

START

Tax Year

COrPOraTION NaMe

reVeNUe ID

eNDING

SCheDUle TO SUPPOrT ClaIM Of exeMPTION frOM

Y/N

COrPOraTe NeT INCOMe Tax UNDer P.l. 86-272

1.

Did the taxpayer make repairs or provide maintenance or service to the product sold? . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

Did sales personnel have the authority to collect payment for current or delinquent accounts? . . . . . . . . . . . . . . . . . . . . . .

3.

Did the taxpayer install or supervise the installation of the product? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

Did the taxpayer conduct training courses or seminars in Pennsylvania for personnel other than personnel

involved in solicitation?

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

Did the taxpayer provide any technical assistance or service including, but not limited to, engineering assistance

or design service, when one of the purposes thereof is other than the facilitation of the solicitation of orders? . . . . . . . . . .

6.

Did the sales personnel investigate, handle or otherwise assist in resolving customer complaints, other than direct

customer complaints in relation to the solicitation of sales? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

Did the sales personnel have the authority to accept and approve orders?

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

Did the sales personnel repossess property?

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

Did the sales personnel secure deposits on sales? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. Did the sales personnel pick up or replace damaged or returned property? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11. Did the taxpayer hire, train or supervise personnel, other than personnel involved only in solicitation?

. . . . . . . . . . . . . . .

12. Did the sales personnel use agency stock checks or any other instrument or process by which sales are made

within Pennsylvania by sales personnel? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. Did the taxpayer maintain a sample or display room in excess of two weeks at any one location in Pennsylvania?

. . . . . . .

14. Did the sales personnel carry samples from which sales, exchanges or distributions were made in any

manner or consideration or other value?

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15. Did the taxpayer own, lease, use or maintain any of the following facilities or property in Pennsylvania:

A)

Any kind of office other than an in-home office located within the residence of the employee that is not

publicly attributed to the company. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

B)

Meeting place for directors, officers or employees.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

C)

Stock of goods other than samples for sales personnel or that are used entirely ancillary to solicitation.

. . . . . . . . . . .

D)

Telephone answering service that is publicly attributed to the company or to employees of the company . . . . . . . . . . . .

E)

Mobile stores, i.e., vehicles with drivers who are sales personnel making sales from the vehicles . . . . . . . . . . . . . . . . .

16. Did the taxpayer consign stocks of goods or other tangible personal property to any person, including an

independent contractor, for sale? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17. Did the taxpayer maintain a telephone listing or other public listing within Pennsylvania for the company or for

an employee as a means of contact? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18. Did the taxpayer enter into a franchise or licensing agreement in Pennsylvania?

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

A complete description of all Pennsylvania business activities must be included. Taxpayers reporting property owned and/or rented in

Pennsylvania and also claiming exemption from corporate net income tax under P.L. 86-272 must provide a description of this property below.

9 60015105

PRINT FORM

Reset Entire Form

1

1