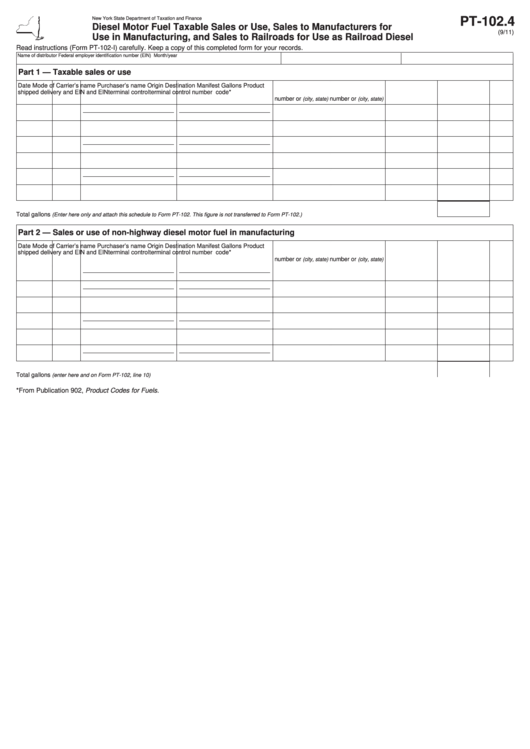

Form Pt-102.4 - Diesel Motor Fuel Taxable Sales Or Use, Sales To Manufacturers For Use In Manufacturing, And Sales To Railroads For Use As Railroad Diesel

ADVERTISEMENT

PT-102.4

New York State Department of Taxation and Finance

Diesel Motor Fuel Taxable Sales or Use, Sales to Manufacturers for

(9/11)

Use in Manufacturing, and Sales to Railroads for Use as Railroad Diesel

Read instructions (Form PT-102-I) carefully. Keep a copy of this completed form for your records.

Name of distributor

Federal employer identification number (EIN)

Month/year

Part 1 — Taxable sales or use

Date

Mode of

Carrier’s name

Purchaser’s name

Origin

Destination

Manifest

Gallons

Product

shipped

delivery

and EIN

and EIN

terminal control

terminal control

number

code*

number or

number or

(city, state)

(city, state)

Total gallons

.................................................................................

(Enter here only and attach this schedule to Form PT-102. This figure is not transferred to Form PT-102.)

Part 2 — Sales or use of non-highway diesel motor fuel in manufacturing

Date

Mode of

Carrier’s name

Purchaser’s name

Origin

Destination

Manifest

Gallons

Product

shipped

delivery

and EIN

and EIN

terminal control

terminal control

number

code*

number or

number or

(city, state)

(city, state)

Total gallons

...........................................................................................................................................................................

(enter here and on Form PT-102, line 10)

*From Publication 902, Product Codes for Fuels.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2