Form Pt-103.1 - Residual Petroleum Product - Receipts And Sales Page 2

ADVERTISEMENT

PT-103.1 (3/01) (back)

Name of petroleum business

FEIN

Month/year

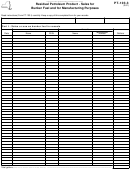

Part IV -

Sales to registered residual petroleum product businesses

(include sales to electric utilities with a

direct pay permit for the production of electricity for sale)

Purchaser’s

Date

Gallons

Name

Address

FEIN

(city and state/province)

Total gallons

.........................................................................................................

(enter here and on Form PT-103, line 9)

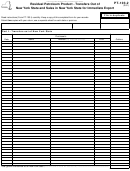

Part V - Sales to the United States government, New York State and municipalities

Date

Name of governmental entity

Gallons

Contract or approval number

Total gallons

........................................................................................................

(enter here and on Form PT-103, line 10)

Part VI -

Sales to exempt organizations

(list sales (except sales for residential heating/cooling – see Form PT-103, line 14) to

exempt organizations qualified under sections 1116(a)(4) or 1116(a)(5) of the Tax Law)

Date

Name and address of exempt organization

Exempt organization number

Gallons

........................................................................................................

Total gallons

(enter here and on Form PT-103, line 11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2